MUMBAI (Commoditiescontrol) – Cotton prices traded strong in the domestic markets during the week ended July 14, thanks to tight supply positions against good demand followed by strong cues from international market.

Exporters and domestic mills were the front-runners and continued their buying spree as they bet on bullish outlook after WASDE report released on July 12.

USDA Revises 2018-19 Cotton Production Estimate Downward To 120.11 Million Bales (Full Report)

Cotton MSP Hike: Decoding Its Implications & Future Scenarios (Full Report)

According to market sources, “Mills are short of cotton, probably 15-30 days and that is why they still are desperate to procure cotton even at the higher level. Further the next crop will be harvested at least 15 days late due to delayed sowing in North India.”

The other key factors that are prompting mills to procure cotton is sharp hike in MSP, and there is higher possibility that cotton price will stay above Rs 44,000 per candy (356kg) as below it, Cotton Corporation of India will turn active to procure at MSP.

India government has increased long stable kapas rate by 26.16% to Rs 5,450/100kg and after ginning it cost around Rs 44,000 per candy.

Gujarat S-6 cotton is currently hovering around 48,500 level at the benchmark Kadi market.

The average cotton price (Gujarat S6) during first four months (Oct-Jan) during 2016-17 and 2017-18 stood at 40,151 per candy and Rs 39,061, respectively.

(We have considered 4 months of initial season as nearly 50% of arrivals reach ginneries during this period)

Cotton Corporation of India (CCI) will have to play an important role next season as there is higher possibility that prices of cotton will be below MSP level as the same was observed in the past couple of seasons.

CCI entry to procure cotton is expected to hurt ginners as they have either to procure cotton at higher rates i.e. above MSP level or shut their operations in case of disparity, which also depends on global price and export.

Indian mills are now considering importing cotton, which they have been avoided so far as domestic cotton is costlier with other origins. Gujarat S-6 at current rate of Rs 48,500 per candy (Oct-Sept) in cents per pound priced around 89-90 range.

At export front, there is slow enquiries for new season cotton, but expert believes it to rise after August once crop outlook gets clear.

At present multinational companies and leading cotton exporters are booking new season cotton crop 2018-19 (Oct-Sept) at around 48,000-48,500 per candy for November.

As far as arrival is concerned it is declining day-by-day with depleting stock, rainfall activity in many states, slow selling by ginners, MNC’s and others.

Daily cotton average arrivals in the country during last week stood lower at 4,733 bales (170kg each) versus 6,200 bales a week ago.

Daily cotton average arrivals in the country during last week stood lower at 4,733 bales (170kg each) versus 6,200 bales a week ago.

Cotton arrivals in the country as on June 28 pegged (CCI) at 3.38 crore bales from estimated crop (CAB) of 373 lakh bales.

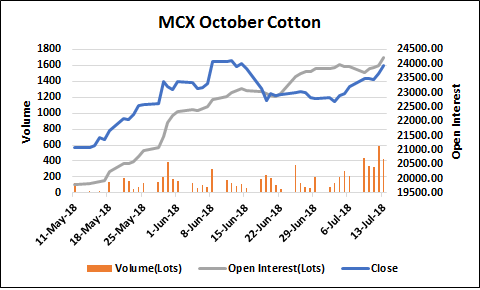

MCX October cotton futures during the week rose over 3% to settle at 22,930 per bale. Volume and open interest increased week-on-week along with price indicating the bullish momentum is likely to continue ahead.

Cotton stock on the MCX warehouses reduced sharply from 161,000 bales on June 12 to 22,700 bales on July 12. The sharp reduction in cotton stock from the exchange warehouses was said to be increased delivery intentions from investors as they buy cotton from MCX and sell it in the spot market due to attractive premium.

Conclusion

India cotton prices are likely to trade positive as mills having short of stock may continue their buying even at the higher rates followed by decent export demand along with slow cotton sowing progress, which was as July 12 stood at 72 lakh hectares versus 91 lakh hectares same period a year ago. However, one should also keep a close eye on US-China trade war and global economic scenario.

(By Commoditiescontrol Bureau; +91-22-40015533)