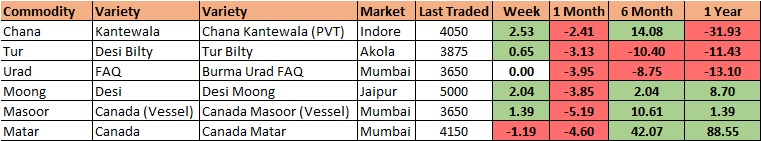

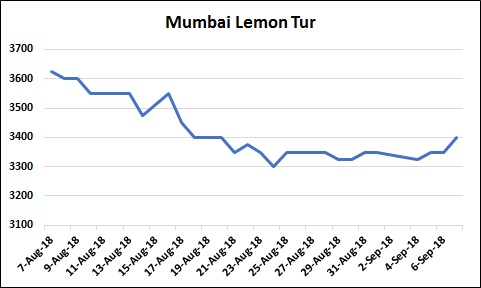

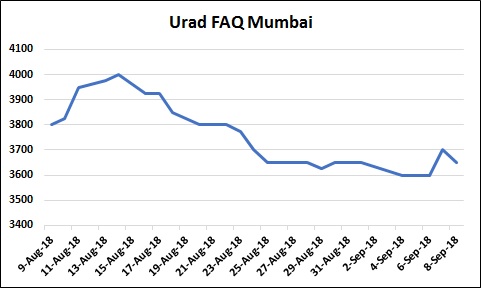

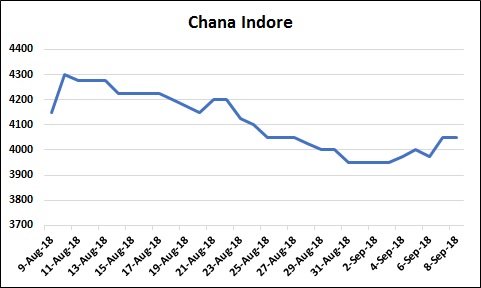

MUMBAI (Commoditiescontrol) – Tur, urad and Chana remained firm during the week ended Saturday (September 04-08) due to fresh millers' buying support at lower levels. While, White Pea declined in the absence of trade activity.

On the other hand, Masoor and Moong prices stayed steady amid thin demand. However, sale counters in processed pulses remained limited during the week despite festive period ahead.

Week Highlights

# India Kharif Pulses Sowing Down 2.2 % As On Sep 7 At 134.41 Lakh Ha Vs 137.45 Last Year. Tur : 45.20 Vs 45.11, Urad : 38.02 Vs 43.44, Moong : 34.05 Vs 31.72, Other Pulses: 16.34 Vs 16.35.

# Rupee Hits Record Low Of 72.11 Against US Dollar.

# Maharashtra Cooperation Dept Calls Meeting on September 10 at 1100-1200 IST at Mumbai office To End Impasse Over APMC Act Amendment.

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained by Rs 50 at Rs 3,375/100Kg at Mumbai market due to fresh millers' buying at lower rates.

In Mumbai, Mozambique origin red and white tur quoted firm by Rs 25 each at Rs 3,000/100Kg and Rs 3,250, respectively amid fresh demand.

Enquiries for both tur whether imported or lying in Nafed godowns are likely to increase in the days to come from millers for crushing as they are facing difficulty in getting domestic tur in Maharashtra. It is to be noted that government agencies have procured maxium tur in Maharashtra.

Domestic tur in bilty trade at Akola also traded higher by Rs 25 at Rs 3,850-3,875/100Kg.

Meanwhile, few markets in Maharashtra opened after being closed for more than a week. Traders and millers were seen purchasing good quality pulses from farmers below MSP albeit mentioning them as average quality.

However, some of the key markets across Maharashtra continued to remain closed throughout the week to protest against the Maharashtra cabinet last month decision to amend the APMC Act making it illegal for any private trader to purchase any agriculture produce below the government-fixed MSP from the coming kharif harvest season.

Latur origin Phatka variety moved up by Rs 50 at Rs 5,650/100Kg for Mumbai delivery on fresh low level buying support. Similarly, Khamgaon origin phatka variety gained by Rs 50 at Rs 5,650/100Kg, Gujarat origin Wasat Phatka variety at Rs 6,150-6,350/100Kg and Jalna origin phatka variety at Rs 5,900/100Kg (Mumbai Delivery).

Sowing Updates

Statewise Kharif Tur Sowing Up 0.2 % As On Sep 5 Vs Last Yr (LAKH HA). Karnataka:9.91Vs 8.79, Maharashtra:12.20 Vs 12.71, Uttar Pradesh:3.47 Vs 3.36, Madhya Pradesh:6.25 Vs 6.47, Gujarat:2.49 Vs 2.68, Telangana:2.77 Vs 2.50, Andhra Pradesh:1.98 Vs 2.16, Odisha:1.43 Vs 1.37, Jharkhand:2.28 Vs 2.43, Rajasthan:0.14 Vs 0.12, Total:45.20 Vs 45.11.

However, recovery in sowing on good rainfall, liquidation of procured pulse and adequate domestic stock left with government may keep prices under pressure.

Burma Urad:

Burma Urad:

In Mumbai, Burma urad traded higher by Rs 50 at Rs 3,650/100Kg due to fresh buying from mills at lower rates.

Arrivals of new Urad witnessed in few markets of Karnataka, Telangana and Maharashtra but the crop was reported having 16-17% moisture content.

Demand in processed Urad remained thin from consumption centres. Bikaner origin branded Urad dal offered at Rs 5,100-5,400/100Kg for Mumbai delivery. Tiranga brand of Mumbai was at Rs 5,325/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 5,300/100Kg for Mumbai delivery.

In Chennai, Urad SQ and FAQ new variety ruled flat at Rs 4,800/100Kg and Rs 3,750, respectively in ready delivery as per condition amid limited millers' buying at existing rates and regular supply of urad at Chennai port from Burma. Urad SQ/FAQ quoted in forward business quoted at Rs 4,875/100Kg and Rs 3,775, respectively for mid September delivery.

According to market sources, prices of urad are likely to get support in the long-term amid reduced sowing in major states as farmers realised lower remuneration from the crop last season, concerns over acreage/area/quality and also on limited imports from overseas, compared to last year due to restriction imposed by the government.

On the other hand, an Uttar Pradesh based trader said that the recent spells of rain over the last one week in Lalitpur/Jhansi/Bundelkhand area may hit the standing crop/ quality and make harvest difficult. New crop arrival is likely to start from September end.

Sowing Updates

Statewise Kharif Urad Sowing Down 12.48 % As On Sep 5 Vs Last Yr (LAKH HA). Karnataka:0.84 Vs 1.30, Maharashtra:3.64 Vs 4.74, Rajasthan:4.72 Vs 5.40, Madhya Pradesh:14.91 Vs 17.89, Uttar Pradesh:6.88 Vs 5.96, Gujarat:1.07 Vs 1.30, Telangana:0.24 Vs 0.30, Andhra Pradesh:0.16 Vs 0.34, Tamil Nadu:0.36 Vs 0.47, Uttrakhand:0.28 Vs 0.28. Total:38.02 Vs 43.44.

Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices moved up by Rs 100 at Rs 4,025-4,050/100Kg due to millers' enquiries and disruption in supplies as market was closed for more than a week on account of labour strike.

Similarly, Australia origin Chana in ready business at Mumbai remained firm by Rs 25-50 at Rs 3,900-3,950/100kg on millers' trade activity at lower rates. While, the commodity ruled flat at Rs 3,975-4,000/100Kg at Mundra port despite limited stock availability. Quality of the commodity in Mumbai was reported average. MMTC was active in selling procured chana at Mundra port.

Similarly, Burma origin chana also traded higher by Rs 50 at Rs 3,950/100Kg in Mumbai on millers' buying due to cheaper prices.

Sentiments are still under pressure due to issuance of tenders by Nafed to sale procured chana in major states, cheaper imports of kabuli chickpea from Sudan & Burma, and limited sale counters in processed chana and besan.

But demand is expected at lower rates in chana dal/besan due to shortage in white pea supply ahead of festive season.

At National Commodity and Derivatives Exchange (NCDEX), Chana September month contract settled lower by 0.9 per cent or Rs 34 at Rs.3,835/100Kgs.

Technically, for NCDEX Chana September Contract, exit long and sell on rise from 3869-3927 with a stop loss of 3992. Expect lower range of 3827-3727 to be tested.

Chana stocks at NCDEX accredited warehouses stood at 52,116 metric tonnes (Akola: 49601, Bikaner 1459, Jaipur 1056) as on 7th september, down 52,348 from the previous session, the exchange data showed.

Australian chana dal quoted unchanged at Rs 4,800/100 Kg for Mumbai delivery amid dull buying activity. Similarly, domestic chana dal of Pistol brand stayed steady at Rs 5,200 for Mumbai delivery, Samrat brand at Rs 5,550 for Mumbai delivery, Angel brand at Rs 5,500 for Mumbai delivery, chana besan at Rs 2,990/50Kg, Vatana besan at Rs 2,750/50 Kg and Vatana dal at Rs 4,750.

In Mumbai, Sudan origin kabuli chickpea moved up by Rs 75 at Rs 3,975/100Kg in ready business. While, Burma origin Kabuli chickpea remained flat at Rs 4,000/100Kg.

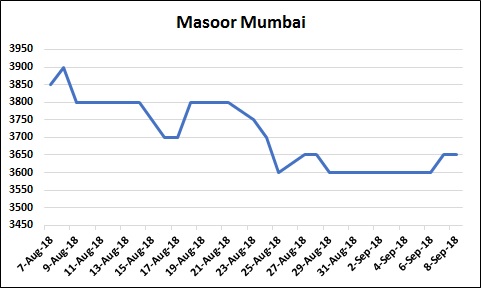

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in Vessel gained by Rs 50/100Kg at Mumbai market amid fresh millers' buying support at lower rates.

Canada crimson variety masoor in vessel also rose by Rs 50 at Rs 3,550-3,650/100Kg. Stock of Canada masoor old in vessel was low and offered as per quality. MMTC was active in selling procured old masoor stock at Rs 3,400/100Kg at Mumbai.

Similarly, Canada crimson Masoor in Container and Australia Masoor nugget variety offered unchanged at Rs 3,600-3,700/100Kg and Rs 3,800-3,900, respectively depending on the quality amid limited stock availability.

As per market sources, upcoming supply from Canada in the near future due to price parity and issuing of tenders from Nafed to sale 59985.28 qunitals of masoor (PSS Rabi 2018) lying in the state of Madhya Pradesh may dampen sentiments in the days to come.

Demand in processed Masoor was also reported limited from consumption centres. Canada Masoor Khopoli spot ruled at Rs 4,700/100Kg.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira ports slipped by Rs 50-150/100Kg as per quality amid dull millers' buying.

Canada White Pea traded at Rs 4,151/100Kg at Mumbai, Rs 3,751-3,851 at Mundra and Rs 4,000 at Hajira port. Russia origin Baltic variety quoted at Rs 3,800 in Mundra. Ukraine White Pea ruled at Rs 4,100 at Mumbai and at Rs 3,950-4,025 at Mundra and Hajira.

Meanwhile, millers and traders preferred to purchase domestic chana and Sudan origin kabuli chickpea due to their cheaper prices as compared to White Pea and also owing to shortage of White Pea stock.

Moreover, demand in Matar dal/besan remained sluggish at prevailing rates.

Prices of White Pea will depend on government decision, whether it will extend import restriction for next quarter till December or will allow import from overseas after September 30,2018.

.jpg) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded unchanged at Rs 4,500-5,000/100Kg as per quality at Jaipur market on slow buying support from mills, arrivals of new crop in Maharashtra, Karnataka and Telangana and on negligible activity as mandies in Rajasthan remained closed from September 1-7 due to strike.

Similarly, Moong dal prices stayed unchanged at Rs 6,000-6,100/100Kg depending on the quality.

Arrivals of new moong witnessed at Kishangarh and Sumerpur markets of Rajasthan with moisture content of around 15-18% and 3-5%, respectively.

Meanwhile, registration process is going on in Karnataka and Telangana and government will start moong procurement soon.

But stockists and traders are not interested to purchase moong as prices are unlikely to gain in future even if moisture levels fall, as crop is expected to remain bumper as compared to last year.

As per Karnataka based trader, local as well as millers from Tamil Nadu were active in purchasing new moong for crushing/polishing.

The Centre has earlier decided to buy 23,250 tonnes of moong at MSP of Rs 6975/100Kg from Karnataka. FCI, NAFED, NCCF and SFC, along with with state-level agencies, will procure moong for 90 days under this scheme. For procurement at MSP, the moisture content is fixed at 12%.

Sowing Updates

Statewise Kharif Moong Sowing Up 7.35 % As On Sep 5 Vs Last Yr (LAKH HA). Karnataka:4.23 Vs 3.64, Maharashtra:3.95 Vs 4.50, Rajasthan:19.23 Vs 15.70, Madhya Pradesh:2.10 Vs 2.28, Uttar Pradesh:0.63 Vs 0.45, Gujarat:0.60 Vs 1.29, Tamil Nadu:0.18 Vs 0.20, Andhra Pradesh:0.11 Vs 0.15, Telangana:0.72 Vs 0.89, Total:34.05 Vs 31.72.

(By Commoditiescontrol Bureau; +91-22-40015513)