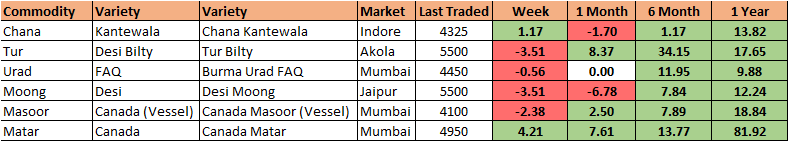

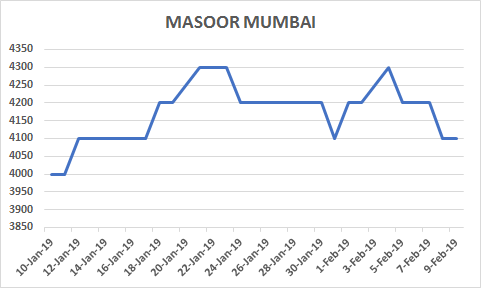

MUMBAI (Commoditiescontrol) – Tur, Urad, Moong and Masoor slipped during the week ended Saturday (February 4-9) due to dull buying support from mills. While, Chana, Kabuli Chana, Green and White Pea gained amid fresh trade activity.

Week Highlights

# India Rabi Pulse Sowing down by 5.75 % as on February 1 to 153.35 lakh Ha vs 162.70 last year at the same period.Chana: 96.35 Vs 107.08, Masoor: 16.90 Vs 17.19, Matar: 10.41 Vs 9.35, Urad: 7.63 Vs 8.56, Moong: 6.81 Vs 7.25, Other Pulses:6.11 Vs 5.76.

# Kolkata customs has restricted release of pulses consignments on 8 Feb 2019, even where Out of Charge has been given, against the backdrop of DGFT order on imports.

# Madras HC Gives Relief To More Pulses Importers on 4 Feb 2019, Grants Stay On DGFT Restriction Order. As per source, post the HC order, cargoes are being cleared from Kolkata port with bank guarantee of 125 percent.

# Canada White Pea Supply-Demand 2018-19 Vs 2017-18 (LT). Output:35.8 Vs 41.12, Import:0.20 Vs 0.12, Export:27 Vs 30.83, Domestic Use:9.01 Vs 6.91, End Stock:6.50 Vs 6.50, Average Rate($/MT): 255-285 Vs 265.

# Canada Masoor Supply-Demand 2018-19 Vs 2017-18 (LT). Output:20.92 Vs 25.59,, Import:0.15 Vs 0.35, Export:17 Vs 15.37, Domestic Use:4.84 Vs 4.95, End Stock:8 Vs 8.76, Average Rate ($/MT): 375-405 Vs 475.

# Maharashtra Will Start Tur Procurement From February 7.

#Centre Gave Permission To Purchase 34500 MT Chana (PSS Rabi 2018-19) In Telangana. Procurement Will Start From Feb 1.

Burma Lemon Tur: Burma Lemon Tur:

Tur Lemon variety of Burma origin declined by Rs 100 to Rs 4,950/100Kg in Mumbai amid dull buying support from mills as demand and sale counters in old and new processed Tur were slack from consumption centres at higher rates.

Selling of old procured Tur stock of Kharif 2017 by Nafed in Gujarat also pressurised the sentiments.

In Mumbai, Mozambique Tur Zebra variety priced at Rs 4,050/100Kg, Gajri variety at Rs 4,600-4,700 and red variety at Rs 4,400.

Similarly, domestic tur in bilty trade at Akola also remained weak at Rs 5,525-5,550/100Kg.

NAFED has successfully procured 57574.53 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on February 8, 2019. Telangana:52381.36, Karnataka:4978.27, Gujarat:214.9.

Latur origin old Phatka variety Tur dal remained weak at Rs 7,050-7,250/100Kg for Mumbai delivery, Gujarat origin Wasat old phatka variety offered at Rs 7,050-7,250/100Kg, Khamgaon origin old Phatka variety at Rs 6,950-7,150/100Kg (Mumbai Delivery) and Jalna origin old phatka variety at Rs 7,150-7,250/100Kg (Mumbai Delivery).

Similarly, Latur origin new Phatka variety also offered lower by Rs 50 at Rs 7,650/100Kg for Mumbai delivery, Gujarat origin Wasat new phatka variety offered at Rs 7,950-8,250/100Kg, Khamgaon origin new Phatka variety at Rs 7,450-7,650/100Kg (Mumbai Delivery), Jalna origin new phatka variety at Rs 7,950-8,150/100Kg (Mumbai Delivery) and Solapur origin new phatka variety at Rs 7,450-7,550/100Kg (Mumbai delivery).

As per market sources, demand and sale counters in new processed Tur were thin from consumption centres as still availibilty of old Tur and Tur dal stock with mills and stockists in domestic market. Demand in old Tur dal was also reported better due to good quality and cheaper prices compare to new tur dal.

Stockiest, small traders and millers had maintained good stock of Tur in anticipation of prices may rise more in near future due to lower output these year compare to last year.

.png) Burma Urad: Burma Urad:

Burma Urad FAQ variety fell sharply by Rs 300 at Rs 4,450/100Kg at the Mumbai market amid dull buying support from mills and weak cues from Chennai, Delhi and Kolkata as the Madras High Court has further given relief to few more importers by granting an interim stay on DGFT import restriction order for pulses.

As per source, post the HC order, cargoes are being cleared from Kolkata port with bank guarantee of 125 percent.

In Chennai, Urad FAQ/SQ varieties ruled weak by Rs 350 each at Rs 4,225-4,250/100Kg and Rs 5,225-5,250, respectively in ready delivery as per condition.

In forward business, Urad FAQ/SQ varieties priced lower at Rs 4,250/100Kg and Rs 5,250, respectively for February 15- March 15 delivery container/godown, sellers option.

Moreover, higher stocks of imported urad at Chennai godowns and upcoming arrivals of domestic crop from Southern markets also pressurised sentiments.

Buyers traded earlier in forward business were demanding to take delivery in containers only, but sellers were interested to give deliveries from godown. Moreover, sellers were hoping prices to decline further and want to settle the forward trade.

However, customs has stopped giving clearances to the containers recently arrived from Burma.

Demand for processed urad from consumption centres remained dull at prevailing prices.

Bikaner origin branded Urad dal priced at Rs 6,200-6,400/100Kg for Mumbai delivery. Tiranga brand of Mumbai also quoted at Rs 6,600/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,500/100Kg for Mumbai delivery.

NAFED has successfully procured 420163.17 MT of Urad at Minimum Support Price of Rs 5,600 as on Feb 8, 2019. Rajasthan: 77444.94, Maharashtra :7699.3, Telangana:578.39, Madhya Pradesh:298599.69, Uttar Pradesh:28633.8,Karnataka: 10.1, Gujarat: 7196.95.

Statewise Rabi Urad Sowing Down 10.86 % As On Jan 30 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:2.61 Vs 3.34, Tamil Nadu:2.70 Vs 2.61, Odisha:2.02 Vs 2.31. Total:7.63 Vs 8.56.

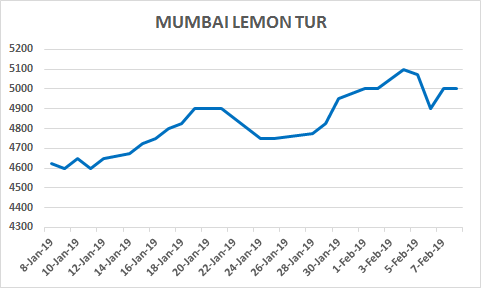

Chana Kantewala (Indore): Chana Kantewala (Indore):

Chana prices remained firm at Rs 4,300-4,325/100Kg in Indore amid buying support from millers as per requirement for crushing.

Flour millers were active in purchasing chana due to cheaper prices and easy availability compared to White Pea.

However, demand in chana dal and besan was thin from consumption centres. Sentiments are still weak as arrivals of new crop are likely to improve and increased availability of the government stock and the rise in selling of chana by the NAFED, especially in the states of Madhya Pradesh and Rajasthan.

Balance Stock of procured Chana with Nafed is 2059347.45 MT as on 7 February, 2019.

Australia origin Chana in ready business at Mumbai and Mundra port moved higher by Rs 25 each at Rs 4,225/100kg, respectively.

Similarly, Burma origin chana priced up by Rs 25 Rs 4,175/100Kg on millers demand.

Ethiopia origin Chana quoted at Rs 4,275/100Kg.

Chana for March delivery on National Commodity and Derivatives Exchange (NCDEX), was settled weak by 0.2 per cent or Rs 7 at Rs 4,269/100kg. Earlier, in the day, the contract hovered in the range of 4,265 and 4,285 on Friday.

Australian chana dal quoted unchanged at Rs 5,400/100 Kg for Mumbai delivery on thin trade activity. While, average and danki quality Australia Chana dal traded at Rs 5,300/100Kg. Domestic chana dal of Pistol brand also offered steady at Rs 5,700 for Mumbai delivery, Angel brand at Rs 6,000 for Mumbai delivery, Samrat brand at Rs 5,900 for Mumbai delivery. Chana besan also priced flat at Rs 3,025/50Kg, Vatana besan at Rs 2,890/50 Kg and Vatana dal at Rs 5,450.

In Mumbai, Sudan/Burma origin kabuli chana traded higher by Rs 25 each at Rs 4,225/100Kg and Rs 4,525, respectively amid limited trade activity by besan flour millers and traders.

Kabuli Chana dollar variety at Indore priced higher by Rs 200-300 at Rs.5,800-6,500/100Kgs as per quality at Indore and also concerns of crop damage of upto 20-30% due to prevailing cold wave conditions.

Kabuli chana of 42-44 and 44-46 counts also traded firm at Rs 7,600/100Kg and Rs 7,400, respectively at Indore market. Arrivals of new Kabuli were reported in Madhya Pradesh.

Statewise Rabi Chana Sowing Down 10.02 % As On Jan 30 Vs Same Period Last Yr (LAKH HA). Maharashtra:13.14 Vs 19.77, Rajasthan:15.03 Vs 15.06, Karnataka:12.38 Vs 13.95, Madhya Pradesh:34.32 Vs 35.50, Uttar Pradesh:5.83 Vs 5.61, Andhra Pradesh:4.61 Vs 5.24, Telangana:1.05 Vs 1.02. Total:96.35 Vs 107.08.

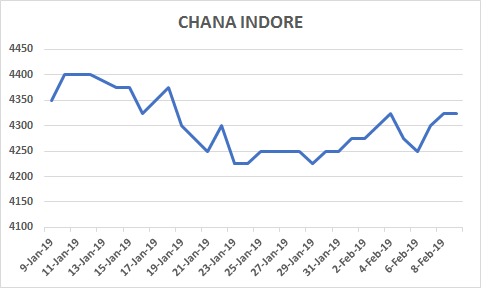

Imported Masoor (Mumbai): Imported Masoor (Mumbai):

Canada origin Masoor in vessel/container both old/new along with Australia Masoor old/new offered weak in Mumbai amid slackened buying and fresh supply in break bulk vessel Bravo at Mundra port.

Prices also pressurised as fresh arrivals of new domestic Masoor are likely to begin from mid February in Madhya Pradesh/Rajasthan and after festive of Holi in Uttar Pradesh. Nafed is also holding procured stock of Masoor in Madhya Pradesh/Uttar Pradesh.

Canada crimson variety masoor in vessel new/old fell by Rs 100-200 to Rs 4,200/100Kg and Rs 4,000-4,100, respectively.

Canada crimson variety masoor in container new/old also offered weak by Rs 100-150 at Rs 4,300/100Kg and Rs 4,200-4,300, respectively.

Similarly, Australia masoor nugget variety both old/new also quoted lower by Rs 100 at Rs 4,300/100Kg and Rs 4,400, respectively as per quality amid limited stock availability.

Demand in processed masoor from consumption centres was reported thin. Canada Masoor Khopoli spot traded flat at Rs 5,200/100Kg.

But, further rise in Tur price may support masoor prices at lower rates due to substitute and also cheaper prices.

Statewise Rabi Masoor Sowing Down 1.69 % As On Jan 30 Vs Same Period Last Yr (LAKH HA)

Madhya Pradesh:5.60 Vs 5.96, Uttar Pradesh:5.80 Vs 5.97, Bihar:2.13 Vs 2.15, West Bengal:1.90 Vs 1.58, Uttrakhand:0.15 Vs 0.15, Jharkhand:0.56 Vs 0.67. Total:16.90 Vs 17.19.

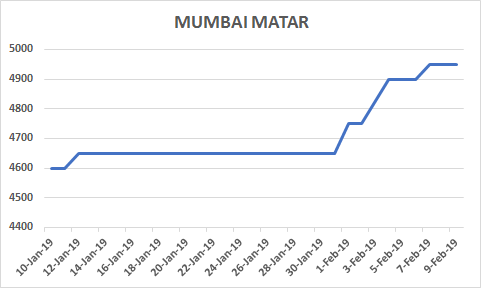

Imported White Pea (Mumbai): Imported White Pea (Mumbai):

Canada origin White Pea and Ukraine White Pea new moved higher by Rs 50/100Kg at Mumbai due to shortage of ready stock, buying support from mills and also custom had stop clearance of bill of entries pertaining to pulses at Chennai/Kolkata port. White pea were allowed to unload in custom Bond Chennai/Kolkata port warehouse.

Canada White Pea old/new along with Ukarine new traded each at Rs 4,750-4,950/100Kg at Mumbai.

However, demand in matar dal/besan remained slow at prevailing rates as millers and traders are preferring to purchase domestic chana or Sudan/Burma origin kabuli chickpea due to cheaper prices as compared to white pea.

Arrivals of new White Pea likely to began from month end in Uttar Pradesh. Crop was been late due to rain and bad weather and also buyers will active in purchasing domestic new crop from Uttar Pradesh in parity compare to imported White Pea.

Statewise Rabi Field Pea Sowing Up 11.34 % As On Jan 30 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:3.69 Vs 2.91, Uttar Pradesh:4.57 Vs 4.17, Assam:0.38 Vs 0.40, Bihar:0.31 Vs 0.32, Chattisgarh:0.45 Vs 0.45, Total:10.41 Vs 9.35.

.png) Moong (Jaipur): Moong (Jaipur):

Moong prices declined by Rs 200 at Rs 5,200-5,500/100Kg as per quality at Jaipur market amid slack millers buying support.

While, Moong dal prices traded unchanged at Rs 6,700-6,800/100Kg, depending on the variety.

However, Nafed were active in selling old procured balance stock of Kharif 2017 in Rajasthan, Madhya Pradesh and karnataka.

NAFED has successfully procured 296093.72 MT of Moong at Minimum Support Price of Rs 6,975 as on Feb 7, 2019. Rajasthan: 236277.28, Karnataka: 29136.74, Telangana: 13375.31, Maharashtra: 13007.73, Madhya Pradesh: 2650.96, Tamil Nadu: 364.9, Haryana: 224.9, Gujarat: 1055.9.

Statewise Rabi Moong Sowing Down 6.07 % As On Jan 30 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:0.87 Vs 0.97, Tamil Nadu:0.71 Vs 0.49, Odisha:4.80 Vs 5.36, Total:6.81 Vs 7.25.

Canada Green Pea (Mumbai):

Canada origin Green pea moved higher by Rs 100 to Rs 7,200/100Kg at Mumbai due to no further supply pressure from overseas as custom has stopped clearance of bill of entries pertaining to pulses at Chennai port. Green pea were allowed to unload in custom Bond Chennai port warehouse.

However, actual buying were reported thin due to sufficient stock at Mumbai and Chennai.

(By Commoditiescontrol Bureau; +91-22-40015513)

|