MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Masoor, White/Green Pea, Chana, Kabuli Chana and Moong moved higher during the week ended Saturday (Dec 16 - 21 ) on fresh buying support . While, Urad prices ruled steady to weak amid dull trade activity.

Week Highlights

# Govt Raises Urad Import Quota To 4 Lakh Tonnes For FY 2019-20.

# Govt Imposes Minimum Import Price Of Rs 200/Kg On Peas.

# Centre Offers 8.47 LT Of Pulses From Buffer Stock To State Governments.

# Karnataka May Offer Up To Rs 500/100 kg Bonus Over MSP For Tur Growers.

# Farmers' Profit Expected To Rise Up To 9% This Year: Report.

# Govt Mulls Nationwide Rollout Of Private Crop Procurement At MSP.

# Jaipur HC Postpones Hearing On Pulses Import Restriction Till Jan 17, 2020 - Sources.

Burma Lemon Tur:

Tur Lemon variety of Burma-origin gained by Rs 175 at Rs 4,950/100Kg in Mumbai amid millers preferred imported Tur or old domestic Tur over new one, due to higher moisture, to meet their crushing requirements.

Similarly, domestic Tur in bilty trade at Akola also ruled higher by Rs 100 at Rs 5,400-5,425/100Kg.

Increasing arrivals of new Tur is witnessed from the producing centers. Moisture content in the arriving crop is higher at around 15-22 percent. Arrivals will, moreover, be delayed due unseasonal weather.

In karnataka, millers have restarted crushing operations of new Tur and likely to be delivered in the market from 1st week of January.

Latur origin new Phatka variety remained weak by Rs 100-150 at Rs 7,900-8,100/100Kg for spot. Gujarat origin Wasat new phatka variety at Rs 8,300-8,500/100Kg, Khamgaon origin new Phatka variety at Rs 7,700-7,900/100Kg (spot), Jalna origin new phatka variety at Rs 8,300-8,500/100Kg (spot) and Solapur origin new phatka variety at Rs 7,900-8,100/100Kg (Spot).

As per trade sources, Tur prices likely to get support once arrivals of new Tur gather the pace in domestic market as millers restart crushing operations. Government will also procure as prices of Tur are trading below MSP. Meanwhile, consumption demand will increase as prices of processed pulses is cheaper compare to vegetables.

Burma Urad:

Burma Urad FAQ new/old variety priced steady to weak each to Rs 7,150/100Kg and Rs 7,000, respectively at the Mumbai market as sentiments were under pressure after the government raised import quota of urad to 4 lakh tonnes, from 1.5 lakh tonnes, for the fiscal year 2019-20.

As per a local trader in Burma, stock of Urad is around 1 lakh tonnes for 2019. Arrivals for new crop are likely to hit the market from 20 January 2020 and the crop size is expected to be 5 lakh tonnes.

However, millers were active in purchasing imported Urad at lower rates, on immediate requirement for crushing, due to scarce arrival of domestic Urad.

Moreover, Customs is yet to issue clearance to containers of urad, imported against the stay order.

This matter is in Jaipur High court, and the next hearing will take place on 16th January, 2020.

Meanwhile, Demand and sale counter in processed Urad reported thin participation at prevailing rates.

Similarly, In Chennai, Urad FAQ/SQ also eased to Rs 7,400-7,450/100Kg and Rs 7,825-7,850, respectively in ready delivery as per condition.

Bikaner origin branded Urad dal traded at Rs 9,800-10000/100Kg for spot. Tiranga brand of Mumbai also unchanged at Rs 10300/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 9,600/100Kg for spot.

Chana Kantewala (Indore):

Chana prices traded almost steady at Rs 4,350/100Kg in Indore amid cautious buying from local millers.

Sentiments are still under pressure due to recovery in Rabi Chana sowing and Government holding major stocks.

However, lukewarm demand for chana dal and besan was reported at wholesale/retail counters.

On other hand, Australia origin Chana in ready business, at Mumbai, moved higher by Rs 50 at Rs 4,250/100kg amid millers' trade and due to limited availability.

Tanzania and Burma origin Chana went up by Rs 50 each at Rs 4,250/100Kg and Rs 4,100/100Kg, respectively.

Chana for January delivery on National Commodity and Derivatives Exchange (NCDEX), settled weak 0.3 percent or Rs 13 at Rs 4,467/100kg. Earlier, in the day, the contract hovered in the range of 4,448 and 4,486 on Friday.

Open interest for NCDEX January contract decreased to 45400 lots against 46210 lots.

On other hand, open interest for March contract increased to 4900 lots against 4360 lots.

Open interest of top 10 trading clients in the long side was 32290 MT whereas the short position of top ten clients was 31450 MT. The net position of top 10 clients was net long by 840 MT.

Chana stocks at NCDEX accredited warehouses stood at 4895 metric tonnes (Bikaner 4,134, Jaipur 761) as on 19th December, the exchange data showed.

Australian chana dal priced firm by Rs 50 at Rs 5,150/100 Kg for spot. Domestic chana dal of Pistol brand also up at Rs 5,350 for Spot, Angel brand at Rs 5,550 for Spot, Samrat brand at Rs 5,550 for Spot. While, Chana besan traded unchanged at Rs 3,125/50Kg.

In Mumbai, Russia/Sudan/Ethiopia origin kabuli chana traded higher each by Rs 50 at Rs 4,150-4,200/100Kg, Rs 4,250 and Rs 4,200, respectively as the Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas and fresh activity from besan flour millers. While, Burma Kabuli Chana remained unchanged at Rs 4,250.

Kabuli chana of 40-42, 42-44 and 44-46 counts gained by Rs 50-100 each at Rs 6,700/100Kg, Rs 6,500 and Rs 6,300, respectively at Indore market amid fresh local buying activity.

Dollar variety Kabuli Chana also moved up by Rs 200 at Rs 5,500-6,200/100Kg at Indore on local trade activity.

In forward business, Russia Kabuli Chickpea offered at $400-$405 per ton in container on CNF basis JNPT for ready shipment.

As per market sources, Chana prices are likely to get support in coming days as the Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas. But gains may be cap due to recovery in rabi Chana sowing. Traders will keep close watch on weather condition during January-February month and also on Nafed policy on liquidation old procured stock.

Imported Masoor (Mumbai):

Canada crimson variety Masoor along with Australia Masoor moved northward at Mumbai pulses market.

Improved demand from the millers, limited stock of ready imported Masoor, import disparity and lag in sowing of rabi masoor, cushions the price.

Consumption of Masoor has shot up due to lower prices.

Even the demand for processed masoor, from wholesaler/retailer counters, was reported to be good.

Canada origin red Masoor in container traded higher by Rs 200 at Rs 4,751/100Kg.

Similarly, Australia origin red Masoor also up by Rs 200 to Rs 4,800/100Kg.

Canada crimson variety Masoor also gained each at Rs 4,661/100Kg and Rs 4,551 at Mundra and Hajira port, respectively.

Canada Masoor dal Khopoli spot traded higher by Rs 250 at Rs 5,550/100Kg.

In forward business, Canada crimson variety masoor new offered at $510 per ton in container on CNF basis JNPT for Dec/Jan shipment.

Australia Nugget variety masoor new offered at $515-520 per ton in container on CNF basis JNPT for Dec/Jan shipment.

Imported White Pea (Mumbai):

Canada-origin White Pea at Mundra port, along with Ukraine origin White Pea in Mumbai moved northward, amid improved buying and shortage of ready stock.

Moreover, Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

The imports have, also, been allowed through Kolkata port only.

White Pea containers continue to be stuck at various ports due to non-issuance of Customs' clearance.

Canada White Pea at Mundra port gained sharply Rs 5,600/100Kg.

Similary, Ukraine White Pea in Mumbai added Rs 900 to touch Rs 5,600/100Kg.

Even prices of White Pea besan also traded higher following uptrend in raw White pea. Vatana besan traded higher at Rs 3,300/50 Kg. Vatana dal also moved up at Rs 6,400.

Moong (Jaipur):

Moong prices traded higher by Rs 200-300 at Rs 6,800-7,100/100Kg as per quality at Jaipur market amid local and outside traders/millers buying activity in good quality moong against diminishing arrivals of Kharif moong.

Similarly, Moong dal also traded firm by Rs 100-200at Rs 8,600/100Kg depending on the variety.

However, Demand and sale counters in processed Moong reported limited activity amid cash crunch.

At Naya bazaar market of Delhi, Rajasthan new kharif Moong traded higher at Rs 6,850-7,250/100Kg.

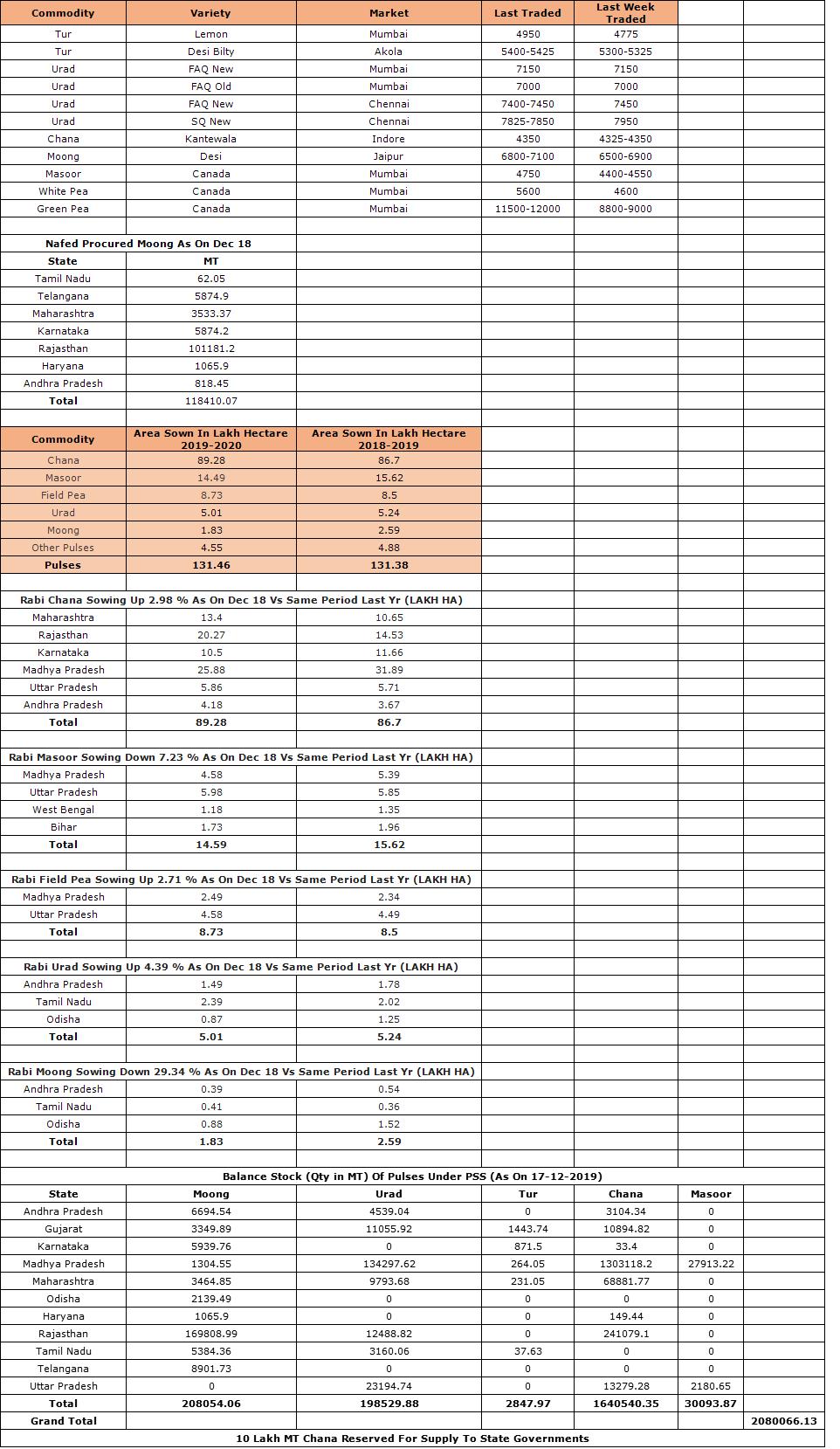

As on December 18, 2019, NAFED has successfully procured 118410.07 MT of Moong at Minimum Support Price of Rs 7,050.

Canada Green Pea (Mumbai):

Canada origin Green pea also witnessed upward rally at Rs 11500-12000/100Kg at Mumbai due unavailibilty of ready stock, as the containers are stuck at Mumbai port awaiting Customs' clearance. Speculators were active in the market.

Moreover, Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

The imports have, also, been allowed through Kolkata port only.

(By Commoditiescontrol Bureau; +91-22-40015513)