MUMBAI, 25 June (Commoditiescontrol): Imported-desi varieties Urad, witnessed a further upward journey this week ended on 25th June 2022, due to regular mills demand.

On weather front, the monsoon advanced in producing belts but is still below expectation.

As per the latest sowing report published by the Ministry of Agriculture, Urad sowing is lagging about 52% as compared to the same period last year. As of June 24, 2022, Urad sowing was at 0.93 Lakh Ha Vs 1.94 Last Year and for the year 2020 for the same period area was 2.19 Lakh Ha. However, we could see some recovery in these numbers if Monsoon improves in Urad growing belts. Urad sowing window is open till mid of July. But it seems difficult that acreage will reach last year's level.

Prices were supported by factors like lower imported ready stock and a slow down in imports due to the import disparity.

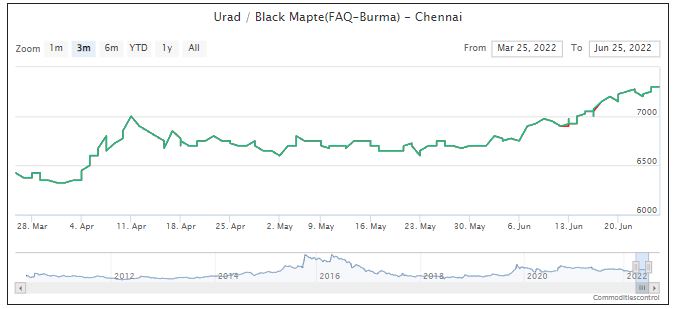

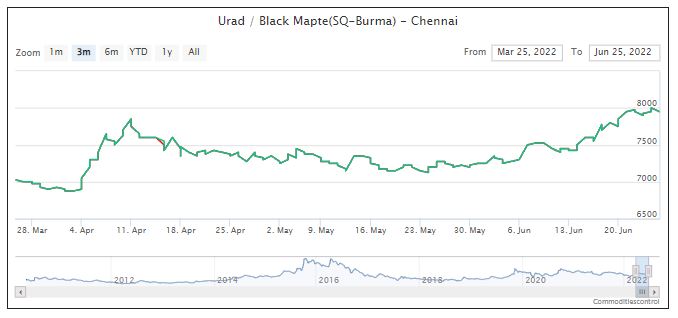

Prices of Burma Urad FAQ variety gained by Rs 50 at Rs 7,225-7,250/100Kg in Mumbai. Similarly, Burma Urad FAQ-SQ varieties in Chennai traded higher each by Rs 100-150 at Rs 7,300/100Kg and Rs 7,950, respectively in ready delivery. In forward business, Urad FAQ is priced at Rs 7,250/100Kg for July delivery and for August 7,350. Urad SQ is priced at Rs 8,025 for July delivery and Rs 8,175 for August. The landed cost of Urad FAQ is Rs 7,400/100Kg for Chennai and for Urad SQ it is Rs 8,175. Import parity is still negative.

.jpg)

In comparison to Raw Urad's demand for processed Urad has not picked up. But as per seasonal trend demand for URad should pick up from August on words .At present summer domestic summer crop and low seasonal consumption is keeping price under check. Further demand from HORECA (Hotel/Restaurant/Cafe) segment is likely to improve substantially in comparison to the previous two years when markets were closed due to lockdowns.

As per Technical Chart Urad FAQ (Mumbai) had cleared resistance. More near term upside probable. Next resistance of Rs 7,700 and followed by Rs 8,300. Click here

In domestic markets, Andhra Pradesh origin new Urad traded higher by Rs 400 at Rs 7,800/100Kg for Delhi delivery.

At Guntur, new Urad polish and unpolished, as per quality, are offered higher by Rs 250-300 at Rs 7,700/100Kg and Rs 7,500, respectively. Similarly, Branded Urad SQ Gota was price also shot up by Rs 400 to Rs 9,950/100Kg.

In the overseas markets, in Burma, Urad FAQ-SQ varieties firmed by $10 each at $920 and $1020, respectively per metric ton on CNF Mumbai. Whereas quotes for Chennai Urad FAQ-SQ were $920 and $1020 per ton on CNF basis.

Earlier it was reported that some Indian buyers had bought some quantity for July delivery with intention to store the stock in Myanmar only but at buying has slowed down at current rates. Indian buyers have purchased FAQ-SQ at $855-$950 on FOB basis for July delivery. No vessel loading of pulses was reported for India (Chennai). Meanwhile, traders informed that 4,000 MT Urad loading in vessel for Bangladesh/Pakistan.

Trend: As per latest sowing report it appears difficult to catchup previous years acreage and dfficent monsoon will result in loss of yield as well.In such scenerio outlook for urad appears to be bullish.Looking into prices it seems makret is not yet facotred in loss of acreage may be after next two three weeks sowing report makret will factor in loss of acreage.It should be noted that demand for Urad is highly enlastic which means quantity demaned may remain not affected much inspite of rise in prices.If monsoon rains not picks up in next two weeks we may witness a sharp rise in Urad prices.

(By Commoditiescontrol Bureau; +91-22-40015513)

|