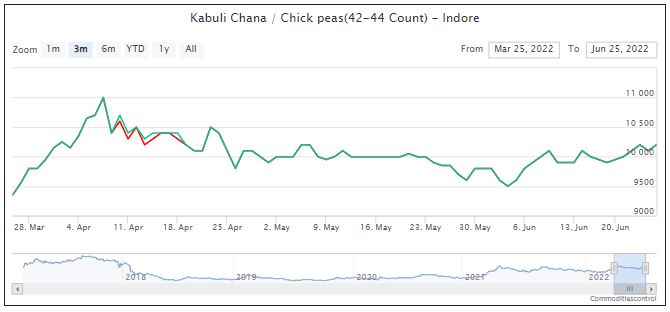

MUMBAI, 25 June (Commoditiescontrol): 42-44 & 44-46 count Kabuli Chickpea prices traded higher for the week ended on 25th June 2022 amid exporters buying support, slow down in arrivals, less domestic crop and negligible carry over stock. Export demand was good from Dubai, Saudi & Algeria.

Export demand was good from Gulf buyers due to short supply of higher counts Kabuli in Mexico, America and Canada. 42-44 count kabuli Chickpea was quoted at 1350 FOB basis for Nhava-sheva/Mundra.

.jpg)

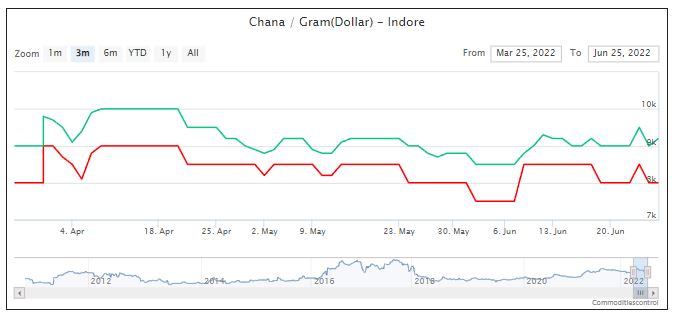

In international markets, Kabuli chana was steady due to lower-than-expected production in Mexico.

On the other hand, combined output in Canada and the United States is expected to advance from 212,000 to 289,000 metric tons (MT) if this year's yields are at their recent five-year average and farmers planted their intended 479,000 acres. But some market participants doubt that North American farmers would have stuck to earlier sowing intentions due to adverse weather conditions during the sowing period and intense competition from other crops. Hence market will be closely watching June 30 USDA and July 5 Statistics Canada seeded area estimates.

The supply position for high-caliber Kabuli chickpeas is likely to remain in international markets as Mexico is the key supplier for North America and European markets. Further European markets which traditionally depended on Russsia will have to depend on other origins thereby making the supply position tighter.

Further seasonal increase in Indian demand after August will make the supply situation further tight.

Trend: Prices of Kabuli Chickpea are likely to remain firm on good export demand on tighter global supply, slow down in domestic arrivals, lower domestic crop, and negligible carry-over stock. Seasonal demand from the domestic market to increase from August onwards. Prices are likely to firm up further keeping in view the new domestic crop will be available only after Feb 23 which is almost eight months.

(By Commoditiescontrol Bureau; +91-22-40015513)