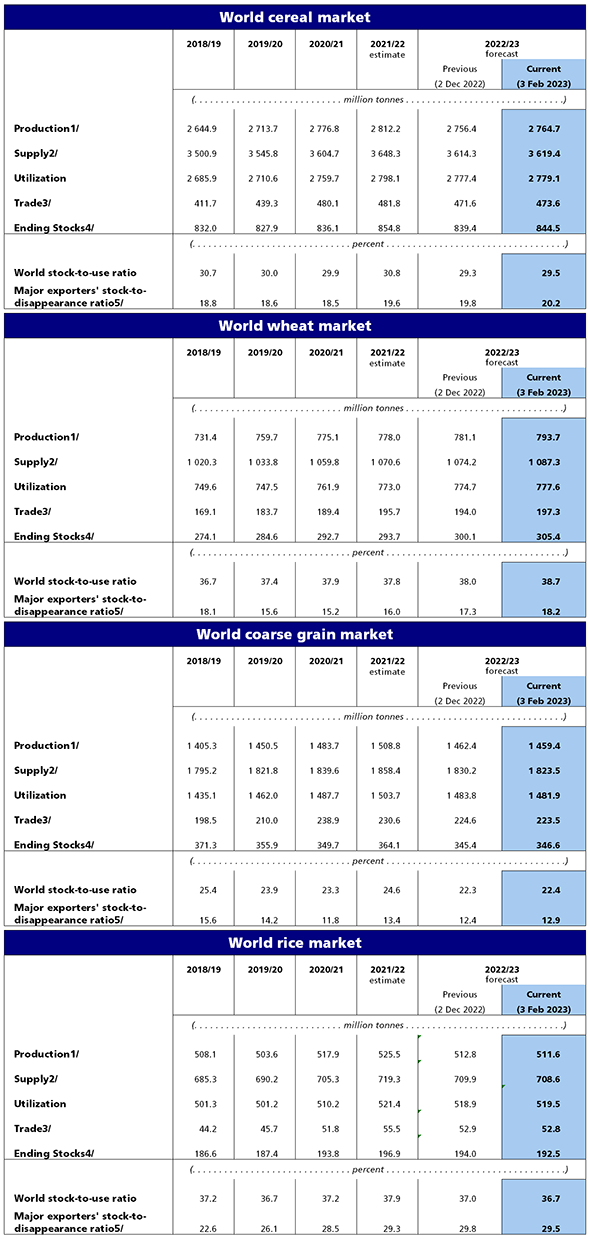

NEW DELHI, Feb 7 (Commoditiescontrol) - FAO’s latest forecast for world cereal production in 2022 has been raised by 8.3 million tonnes (0.3 percent) this month to 2,765 million tonnes, albeit still 1.7 percent lower year-on-year. The increase is predominantly related to wheat, reflecting upward revisions made for Australia and the Russian Federation, which raised the forecast for the global wheat output to 794 million tonnes and reinforced the expectations for a record-high outturn in 2022.

|

|

| |

For coarse grains, global production is pegged at 1,459 million tonnes in 2022, moderately down compared to the preceding forecast in December and now 3.3 percent below the level in 2021. The most recent cut reflects lower maize production estimates for the European Union, the United States of America and the Russian Federation, which more than offset an upward revision for China.

The forecast for the world barley outturn has been raised moderately, resting on an upturn in harvest prospects in Australia, while the forecast for global sorghum production remains unchanged from December.

As for rice, assessments released by Chinese officials in December, point to a lower level of plantings than previously envisaged by FAO, especially in north-eastern producing areas, which added to some yield decreases caused by heat and dryness in the southern parts of the country. The downward revision for rice production in China more than offset upward revisions made for several other countries, most notably Bangladesh, where authorities report positive outcomes for the second most important crop of the season, despite some rainfall-related setbacks at the planting stage. As a result, global rice production is now forecast in the order of 512 million tonnes (milled basis), down 1.2 million tonnes lower than the December forecast and 2.6 percent from the 2021 all-time high.

Looking ahead to production in 2023, the bulk of the winter wheat crop has been planted in the northern hemisphere and early indications point to area expansions in several major producing countries, driven primarily by the elevated prices. While fertilizer prices dropped in recent months, they continue to be high, which could result in reduced application rates with likely adverse implications for yields.

In the United States of America, 2023 winter wheat planted area is estimated to be the largest area in eight years, up 11 percent year-on-year. Drought conditions are affecting the main producing Central Plains and are forecast to continue in the next months; however, the dry weather has partly receded elsewhere, leading to improvements in crop conditions.

In Canada, while the bulk of the wheat crop is planted in spring, and although a pullback in winter sowings is foreseen, total wheat plantings are predicted to expand by 2 percent in 2023, underpinned by remunerative crop prices.

In the European Union, official winter wheat area estimates are not yet available, but aided by generally conducive weather and supported by prevailing price incentives, sowings are anticipated to remain above the previous three-year average and close to the 2022 level. In the United Kingdom of Great Britain and Northern Ireland, expectations indicate a 1 percent upturn in winter wheat sowings, supported by beneficial weather and robust output prices.

In the Russian Federation, ample domestic availabilities and low domestic prices could result in a small cutback in wheat plantings. In Ukraine, severe financial constraints, infrastructure damage and obstructed access to fields in parts of the country have resulted in an estimated 40 percent year-on-year reduction in the 2023 winter wheat area.

In India, spurred by higher market and government-guaranteed prices, as well as beneficial sowing conditions, the 2023 wheat acreage is anticipated to exceed last year’s record level.

In Pakistan, 2023 wheat sowings are foreseen to remain higher than the five-year average, with standing water from the large-scale floods in 2022 causing less hindrance than initially anticipated.

In southern hemisphere countries, most of the 2023 coarse grain crops were planted by late 2022. Driven by attractive prices, farmers in Brazil could increase the total maize plantings to a record high, with much of the increase concentrated in the key-producing Mato Grosso state. In Argentina, low soil moisture levels curtailed maize sowings of the early-planted crop, and consequently, the total maize area is expected to contract marginally in 2023. In South Africa, in part reflecting ample domestic supplies, there was a 3 percent cutback in 2023 maize sowings; weather conditions have so far been favourable, auguring well for yield prospects.

World cereal utilization in 2022/23 is predicted to contract by 19 million tonnes (0.7 percent) from the 2021/22 level, reaching 2 779 million tonnes, despite a 1.7-million-tonne upward revision since the December forecast.

The monthly increase mostly stems from a 3.0-million-tonne upward adjustment to wheat utilization, predominantly on account of higher feed use of wheat in China, the European Union and the United States of America. Following this upward revision, global wheat utilization in 2022/23 is forecast at 778 million tonnes, up 4.6 million tonnes (0.6 percent) from the 2021/22 estimated level.

By contrast, lower anticipated feed use, mostly of maize in the European Union, Russian Federation, United States of America and Viet Nam and of sorghum in China, has led to a downward revision of 1.8 million tonnes to FAO’s forecast for total utilization of coarse grains in 2022/23, now pegged at 1 482 million tonnes, some 22 million tonnes (1.4 percent) below the estimated level for 2021/22.

A 0.6 million tonne upward revision has raised FAO’s forecast of global rice utilization in 2022/23 to 519.5 million tonnes, marginally changed from the 2021/22 peak, reflecting expectations that increases in rice food intake will largely compensate for anticipated cutbacks in use of rice for feed and industrial purposes.

The new forecast for world cereal stocks stands at 844 million tonnes, up 5 million tonnes since December but still 10.3 million tonnes (1.2 percent) below the record high opening level. At this level, the world stocks-to-use ratio of cereals would decrease from 30.8 percent in 2021/22 to 29.5 percent in 2022/23, but still indicate a relatively comfortable supply level.

The bulk of this month’s higher forecast for world cereal inventories stems from an upward revision (5.3 million tonnes) to global wheat stocks, mostly attributed to higher inventories anticipated in Australia, the Russian Federation and the European Union. With this month’s upward revision, the forecast for global wheat stocks in 2022/23 has been raised to 305 million tonnes, up 12 million tonnes (4.0 percent) from their opening levels.

FAO’s forecast for coarse grain inventories (ending in 2023) has also been revised up since December, by 1.2 million tonnes, mostly reflecting expectations of higher barley stocks in the European Union on account of lower feed use. Despite the upward revision, world coarse grain stocks are still forecast to fall by 18 million tonnes (7.3 percent) in 2022/23, to 283 million tonnes, dominated by a foreseen 22-million-tonne (7.3 percent) drawdown in global maize inventories.

Largely reflecting a downward revision to carry-overs in China, global rice stocks at the close of 2022/23 marketing seasons are now seen 1.5 million tonnes below the December forecast at 192.5 million tonnes, implying a 2.3 percent contraction from the record high stocks reached in 2021/22, butstill the third largest rice reserves on record.

Notwithstanding an upward revision of 2.0 million tonnes this month, international trade in cereals is forecast to decline by 8.2 million tonnes (1.7 percent) from the previous season’s record volume to 474 million tonnes in 2022/23.

FAO’s forecast for global wheat trade in 2022/23 has been raised by 3.2 million tonnes since December, mostly reflecting higher expected sales by the Russian Federation owing to ample supplies, competitive prices and a robust pace of shipments in recent months. Offsetting some of that increase, Argentina’s export forecast has been lowered in view of the reduced production. On the import side, greater than previously anticipated purchases are seen for the European Union, mostly from Ukraine, and by China, based on the brisk pace of imports observed so far.

Global trade in coarse grains in 2022/23 (July/June) is forecast to fall 3.1 percent from the 2021/22 level to 223 million tonnes, down 1.2 million tonnes from the December forecast. This month’s downward adjustment mostly reflects a lower outlook for sorghum trade, driven by weaker demand from China and consequential smaller sales by the United States of America.

The forecast for global maize trade remains nearly unchanged this month, as larger expected sales from Brazil offset a cut to the United States of America export forecast, and, on the import side, greater foreseen purchases by the European Union balance a downward revision to imports by Viet Nam. International trade in rice in 2023 (January-December) is pegged at 52.8 million tonnes, essentially unchanged from the December forecast, but down 4.7 percent from the 2022 estimate, which was revised up to an all-time of 55.5 million tonnes.

(By Commoditiescontrol Bureau)