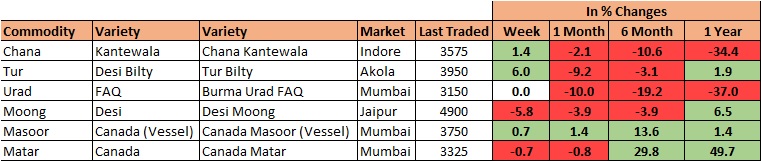

MUMBAI (Commoditiescontrol) – Tur, Chana and Masoor prices moved for the week ended Saturday (June 11-15) amid fresh millers' buying support at lower rates. While, Moong prices remained weak on slack trade against adequate supply.

On the other hand, Urad and White Pea quoted unchanged due to slow buying interest.

Week Highlights

# India Kharif Pulses Sowing Down 10 % As On June15 At 2.52 Lakh Ha Vs 2.80 Last Year. Tur : 0.52 Vs 0.46, Urad : 0.48 Vs 0.67, Moong : 0.69 Vs 0.75, Other Pulses: 0.68 Vs 0.84.

# Australia 2018-19 Chana Crop Likely To Fall 40% Y/Y At 6.16 Lakh Tonne.

# MP Govt Will Start Procurement Of Summer Urad Crop At MSP From June 21 To Jul 20. Registration To Start From Jun 6-20.

# Rajasthan Raises Chana Procurement Target by 2LT To 5.88LT For 2017-18 At MSP.

# Monsoon In India To Make Slow Progress Over The Next 2 Weeks: US Forecaster.

Burma Lemon Tur: Burma Lemon Tur:

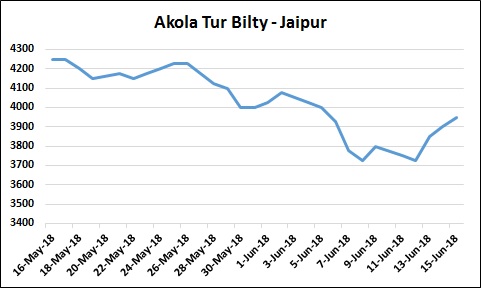

Tur Lemon variety of Burma origin moved up by Rs 75 at Rs 3,450/100kg due to millers' buying support at lower rates, slow domestic arrivals and delayed monsoon.

In Mumbai, Mozambique origin white tur was also firm by Rs 50 at Rs 3,100/100Kg and red tur by Rs 25 at Rs 2,825/100Kg.

Similarly, domestic new tur in bilty trade at Akola traded higher by Rs 125 at Rs 3,925-3,950/100Kg.

However, demand in tur dal was reported slow from wholesalers and retailers. But it is expected after end of Ramzan due to empty pipeline. Tur dal prices will also get support at lower prices due to costly vegetables and decline in consumption of Mango owing to arrival of rainy season.

But mport of tur from overseas at cheaper rates despite farmers and government's agencies are sitting on a massive stock will limit the gains. Moreover, millers' preference to crush old crop and average quality tur, purchased from government at lower rates will surely going to weigh on prices further.

Meanwhile, Indian government has issued licences for import to domestic importers and they contracted to import around 50 containers of tur at prevailing CNF rates, which has pushed up prices in Burma market. Major buyers were from Chennai and Mumbai. Loading will start from next week for India and expected to hit Indian shore by first week of July.

Arusha tur offered at $400 per ton, Burma Shegai tur at $418-422, Sudan tur at $430-440, Malawi tur ar $330-340 and Mozambique tur (good quality) at $360-370 on CNF basis Nhava- Sheva for June-July shipment.

India Kharif Pulses Sowing Down 10 % As On June15 At 2.52 Lakh Ha Vs 2.80 Last Year

Tur : 0.52 Vs 0.46.

Statewise Kharif Tur Sowing Up 13.04 % As On June 13 Vs Last Yr (LAKH HA). Karnataka: 0.18 Vs 0.17, Uttar Pradesh: 0.26 Vs 0.22, Gujarat: 0.02 Vs 0.01, Uttrakhand: 0.03 Vs 0.03, Assam: 0.02 Vs 0.03. Total: 0.52 Vs 0.46.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal new Phatka Sortex quality traded higher by Rs 75 at Rs 5,475, new semi-Sortex at Rs 5,375, new regular variety at Rs 5,275 respectively.

Latur origin new Phatka variety priced firm at Rs 5,400-5,600/100kg due to limited buying. Jalna origin new phatka variety also remained steady at Rs 5,600-5,800/100Kg. Gujarat origin Wasat Phatka variety stayed steady at Rs 5,800-6,000/100Kg.

Pulses farmers in Maharashtra are not seem to be happy despite Maharashtra government has decided to pay Rs 1,000 per quintal to tur and chana growers.

Government procurement of Tur/Chana has already completed in the state. The farmers who had registered earlier for the procurement had to take it back home. Farmers have to sell their stock below MSP to private traders in the market as government itself selling last year’s tur currently, lying in warehouses at lower rates.

Moreover, the government has given approval to millers to import pulses and sell them in the market after processing them.

The import is allowed for year 2018-19 and is expected to hit the market by July-August. This will lead to a glut in the market.

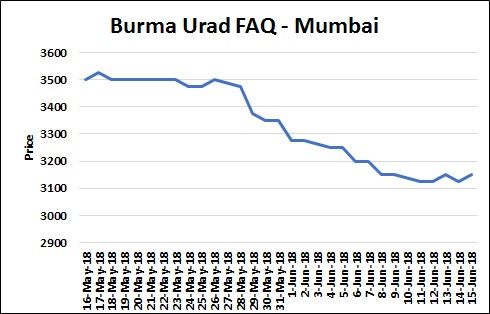

Burma Urad: Burma Urad:

In Mumbai, Burma urad FAQ variety remained unchanged at Rs 3,150/100Kg due to dull buying, liquidation of procured stock by government agencies, adequate stock position and approval for import from Burma at cheaper rates.

Meanwhile, Indian government has issued licences for import to domestic importers and they contracted to import around 150 containers (24MT each) of urad at prevailing CNF rates , which has pushed up prices in Burma market. Major buyers were from Chennai and Mumbai. Loading will start from next week for India and expected to hit Indian shore by first week of July.

Moreover, demand for processed urad from consumption centres remained lacklustre at prevailing rates.

Bikaner origin branded Urad dal offered at Rs 4,300-4,600/100Kg. Tiranga brand of Mumbai at Rs 4,900/100Kg.Parivar brand of Jalgaon at Rs 4,700/100Kg.

At Chennai, Urad SQ/FAQ variety declined in ready delivery at Rs 4,150/100Kg and Rs 3,100, respectively due to negligible trade despite sellers were active in the market.

Sellers were active and liquidating Urad SQ and FAQ variety at Rs 3,950/100Kg and Rs 3,000, respectively for whole July delivery.

Statewise Kharif Urad Sowing Down 28.36 % As On June 13 Vs Last Yr (LAKH HA). Karnataka:0.18 Vs 0.24, Tamil Nadu:0.09 Vs 0.26, Uttar Pradesh:0.05 Vs 0.009, Uttrakhand:0.11 Vs 0.12.Total:0.48 Vs 0.67.

.jpg) Chana Kantewala (Indore): Chana Kantewala (Indore):

At Indore market, Chana prices traded higher by Rs 125 at Rs 3,575/100Kg due to improved millers' buying, slow domestic arrivals, firm cues from futures and weak kharif sowing due to delayed monsoon.

Meanwhile, farmers are preferring to sell to government at MSP instead of selling at lower prices in market.

Sale counters in processed chana and besan were still thin at lower rates. But, price difference between chana and white pea has been reduced and likely to support chana prices in near future after Ramzan. Since the available matar stocks have been exhausted, buyers may shift to chana, which is a close substitute for White Pea.

Similarly, Australia origin Chana at Mumbai and Mundra ports gained by Rs 50-75 each at Rs 3,300/100Kg and Rs 3,375, respectively.

Chana stocks at NCDEX accredited warehouses stood at 42,241 metric tonnes as on 14th June, up from 42,040 metric tonnes in the previous session, the exchange data showed. Akola:39436, Bikaner 1659, Jaipur 1146.

Technically, for NCDEX Chana July Contract, cover short position at 3317 or below. Expect higher range of 3452-3549. Further weakness is below 3292.

NAFED Procures (Rabi 2017-18) 2470533.938 MT Chana As On 10 June At MSP Prices Of Rs 4400. Madhya Pradesh:1564006.764, Maharashtra:155131.003, Rajasthan:421742.352, Gujarat:71507.155, Uttar Pradesh:3182.900, Telangana:50000.050(Target completed on 10.04.2018), Karnataka:127301.264(Target completed on 22.04.2018), Andhra Pradesh:77662.450(Target completed on 1.05.2018).

Australian chana dal gained by Rs 50 at Rs 3,950/100 Kg amid better trade activity. Domestic chana dal of Pistol brand priced higher at Rs 4,100, Samrat brand at Rs 4,450 and Angel brand at Rs 4,400. On other hand, Chana besan priced lower at Rs 2,581/50Kg. Vatana besan traded weak at Rs 2,141/50 Kg and Vatana dal at Rs 3,750.

Kabuli Chana of 42-44 and 44-46 counts traded flat at Rs 5,500/100Kgs and Rs 5,300, respectively at Indore due to slow domestic/overseas demand, ample stock in the country and price parity. Supply of the commodity had increased this week after farmers strike ended on June 10.

Similarly, Kabuli Chana dollar variety priced steady at Rs.4,500-5,200/100Kgs at Indore on slack trade and regular arrivals.

.jpg) Imported Masoor (Mumbai): Imported Masoor (Mumbai):

Canada origin masoor in Container and vessel along with Australia Masoor moved up by Rs 25 in Mumbai amid millers' buying support, no supply pressure from overseas and slow arrivals of domestic crop.

Also, sellers were not interested to liquidate the pulse at existing prices amid depleting stock of imported masoor.

Canada crimson variety masoor in container and vessel traded at Rs 3,750-3,850/100Kg and Rs 3,750, respectively. Stock of Canada masoor old in vessel was low and offered as per quality.

Similarly, Australia Masoor nugget variety moved higher at Rs 3,950-4,050/100Kg as per quality against limited stock.

However, demand in processed Masoor was reported thin from consumption centers. Canada Masoor Khopoli spot priced at Rs 4,250-4,350/100Kg.

In forward business, Canada crimson variety masoor offered at $410 per ton in container on CNF basis Nhava- Sheva for July-August shipment. Australia nugget variety masoor offered at $440 per ton in container on CNF basis Nhava- Sheva for July-August shipment.

NAFED Procures (Rabi 2018) 230123.81 MT Masoor As On 13 June At MSP Prices Of Rs 4250. Madhya Pradesh:225912.43, Uttar Pradesh:4211.38.

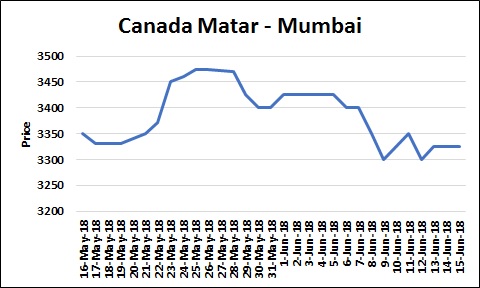

Imported White Pea (Mumbai): Imported White Pea (Mumbai):

Imported White Pea of all origins, such as Canada, Russia and Ukraine at Mumbai port stayed steady as per quality due to thin trade activity at existing rates and fresh supply from overseas.

Canada White Pea offered at Rs 3,325/100Kg at Mumbai, Rs 3,250 at Mundra and Rs 3,301 at Hajira port. Russia origin Baltic variety quoted at Rs 3,200-3,250 at Mumbai and Rs 3,121-3,171 in Mundra. Ukraine White Pea priced at Rs 3,200-3,250 at Mumbai.

Further demand in Matar dal/besan was slow at prevailing rates due to fresh overseas supply of White Pea, but to a lesser extent. The prices are expected to rule firm due to reducing stock and low supply pressure from overseas in the wake of quantitative restriction imposed by the Indian government.

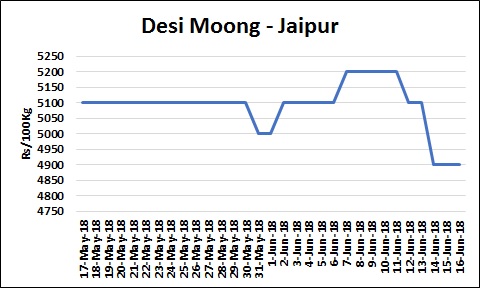

Moong (Jaipur): Moong (Jaipur):

Moong prices quoted lower by Rs 100-200 at Rs 4,700-4,900/100Kg as per quality in Jaipur market during the week on subdued millers' buying at prevailing rates.

Similarly, Moong dal prices also ruled weak by Rs 100 at Rs 5,900/100Kg as per quality.

According to market sources, prices of moong are likely to trade range-bound due to adequate stock position and regular supplies of summer crop in Madhya Pradesh, Uttar Pradesh and Gujarat.

Meanwhile, government agencies are also active to sale their procured stock in Rajasthan, Madhya Pradesh, Andhra Pradesh, Karnataka and Maharashtra.

Kenya Moong offered at $640 per ton, Tanzania Moong at $600-610 and Mozambique Moong at $595 on CNF basis Nhava- Sheva for ready shipment.

Statewise Kharif Mung Sowing Down 8 % As On June 13 Vs Last Yr (LAKH HA). Karnataka:0.57 Vs 0.63, Tamil Nadu:0.09 Vs 0.10, Andhra Pradesh:0.02 Vs 0.01, Uttar Pradesh: 0.02 Vs 0.007, Total:0.69 Vs 0.75.

(By Commoditiescontrol Bureau; +91-22-40015513)

|