International Soybean Market Recap

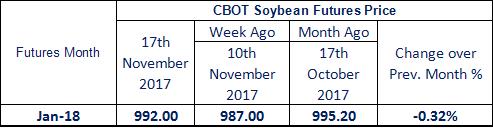

MUMBAI (Commoditiescontrol) - CBOT Soybean Futures ended the week with a bounce. January soybean contract rose 1.9% to $9.90 1/2 a bushel at the Chicago Board of Trade.

There were no substantial bearish reasons during the week to sell, traders explained.

Trade needs more negative news to dive market lower. In particular, speculative players like hedge funds are already holding overall large long positions in Soy Complex markets, leaving little room for further selling without new indications of real bearish factors to drive prices lower.

Meanwhile, soybean traders were immensely concerned with dry weather in Argentina, a major crop producer. The center of the country would continue to dry out for the rest of the month, stressing around half of the country's soybeans.

This helped to create buying interest in the soybean market this week.

Domestic Market Recap

During the week, spot soybean ruled steady amid matching supply and demand. Soybean prices in the spot markets during the week ended on November 18 ruled steady at Rs 2,750/100kg in line with our expectation. Soybean price traded below the MSP for seventh consecutive week.

.jpg)

Total new crop arrivals during the week, were reported at 7.6 to 8.20 lakh bags against 7.5 to 8.25 a week ago.

Evidently, arrivals are still below market expectation which has raised the question on SOPA’s soybean production which accounted to be 90 lakh tonnes. According to traders, at current situation supply of soybean in the market should have been around 9.50-10 lakh bags. Likewise, in coming week if arrival does not increase to 10 lakh bags then we may not see any major fall in soybean price.

Indian Government has hiked import tax on crude soya oil to 30% from 17.5% earlier. The order was released on late Friday. Further, government has also hiked import duty on soybean seed to 45% from previous 30%. The decision is expected to support farmers.

Due to hike in import duty of edible oil crush margin has also improved drastically.

| Particulars |

Spot Rs. |

| Soybean Ex Plant Per 100kg |

2775.00 |

| A Soybean Price/MT |

27750.00 |

| B Crush Expenses/MT |

1350.00 |

| Cost/MT (A+B) |

29100.00 |

| Soy Ref Oil Price (Excl. Vat/10Kg) |

680.00 |

| Refining Exp. (10Kg) |

25.00 |

| Solvent Extr. Oil (Price/10Kg) |

655.00 |

| C Oil realisation (Rs/MT) |

11790.00 |

| DOC Ex. Indore (Price/MT) |

21000.00 |

| D DOC Realisation(Price/MT) |

17325.00 |

| Total Realisation (C+D) |

29115.00 |

| Net Crush Margin(Rs/MT) (Based on Ex.Indore Meal & oil) (C+D) - (A+B) |

15.00 |

| Gross Crush Margin(Rs/MT) |

1365.00 |

| Gross Crush Margin(US $/MT) |

21.00 |

| Oil share (in %) |

40% |

| Meal Share (in %) |

60% |

| Particulars (Post Import Duty Hike) |

Spot Rs. |

| Soybean Ex Plant Per 100kg |

2875.00 |

| A Soybean Price/MT |

28750.00 |

| B Crush Expenses/MT |

1350.00 |

| Cost/MT (A+B) |

30100.00 |

| Soy Ref Oil Price (Excl. Vat/10Kg) |

750.00 |

| Refining Exp. (10Kg) |

25.00 |

| Solvent Extr. Oil (Price/10Kg) |

725.00 |

| C Oil realisation (Rs/MT) |

13050.00 |

| DOC Ex. Indore (Price/MT) |

21000.00 |

| D DOC Realisation(Price/MT) |

17325.00 |

| Total Realisation (C+D) |

30375.00 |

| Net Crush Margin(Rs/MT) (Based on Ex.Indore Meal & oil) (C+D) - (A+B) |

275.00 |

| Gross Crush Margin(Rs/MT) |

1625.00 |

| Gross Crush Margin(US $/MT) |

25.00 |

| Oil share (in %) |

43% |

| Meal Share (in %) |

57% |

SOYMEAL

Soymeal at the benchmark Indore market traded down by Rs 400 to trade at Rs 21,000 per tonne amid poor demand of soymeal in international market.

However, demand from poultry feed manufacturers for the commodity in domestic market is gradually improving. Primarily due to increased in placement of chicks for upcoming peak winter demand of broiler chicken across India.

Prices of broiler chicken in benchmark Delhi market traded steady during the week at Rs 95/kg.

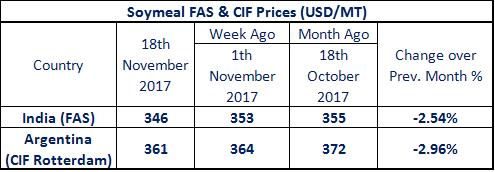

Indian Soymeal was priced at $346 per tonne FAS Kandla Vs $361 Argentina CIF Rotterdam (November) as of November 11, 2017.

If we consider the freight of around $35 per tonne for bulk exports to European destination and insurance of $1 per tonne then Indian soymeal CIF rotterdam price comes at $382 which means that Indian soymeal is costlier by $21 compared to Argentine soymeal. But, as the Indian soymeal is non-genetic soymeal while its counterpart, Argentine soymeal is genetically modified, overseas buyers are ready to pay premium of $10 for Indian soymeal.

SOYOIL

.jpg)

Refined soy oil in benchmark Indore market of Madhya Pradesh till Friday trading session declined by Rs 10 to trade at Rs 680/10kg on account of poor demand. However, on Friday late night, government hiked import duty on soy oil from 17.55 to 30% which has increased the soy oil price by Rs 750/10kg.

| Soybean Oil at Kandla |

|

|

|

|

|

| Particulars(Pre Import Duty Hike) |

Amount |

| CIF at Indian Port $/MT (Landed Wt Aug Shipment) |

840.00 |

| US $ rate |

65.50 |

| Rs/MT |

55020.00 |

| Tariff $/MT |

862.00 |

| Net Duty $/MT @17.575% |

151.50 |

| Imp. Duty PMT@Rs 66.20/$ |

10029.07 |

| Import Expenses Rs/MT |

1000.00 |

| Landed Cost Rs/MT |

66049.07 |

| Landed Cost Rs/10Kg |

660.49 |

| Soybean Oil at Kandla |

|

|

|

|

|

| Particulars(Post Import Duty) |

Amount |

| CIF at Indian Port $/MT (Landed Wt Aug Shipment) |

840.00 |

| US $ rate |

65.50 |

| Rs/MT |

55020.00 |

| Tariff $/MT |

862.00 |

| Net Duty $/MT @30.90% |

266.36 |

| Imp. Duty PMT@Rs 66.20/$ |

17632.90 |

| Import Expenses Rs/MT |

1000.00 |

| Landed Cost Rs/MT |

73652.90 |

| Landed Cost Rs/10Kg |

736.53 |

NEXT WEEK: Soybean prices are likely to trade higher on account of increased duty on Soya Oil and Soyabean.

(By Commoditiescontrol Bureau; +91-22- 40015516)