Ahmedabad, June 18 (CommoditiesControl): Today, the cumin market in Gujarat saw robust pricing as arrivals dwindled, providing a boost to market rates. Traders noted a significant decrease in cumin arrivals, which bolstered prices by Rs 50 per 20 kg across the state.

The cumin trade is closely watching the supply dynamics as lower arrivals continue to support the upward trend in prices. If the arrival remains subdued in the coming days, further improvement in cumin prices is anticipated.

Export activities in cumin have not shown significant traction, contributing to the current market conditions. The market is also closely monitoring the new crop arrivals from China, as the pricing dynamics there can influence the Indian market.

In Gujarat, apart from Unjha, other cumin centers have also reported decreased arrivals. Market sentiment suggests that if arrivals in the Unjha market drop below 10,000 bags, prices could witness additional upward momentum. Conversely, higher arrivals could pose challenges to further price hikes. Export demand remains sluggish, with Bangladesh showing limited interest alongside other international markets.

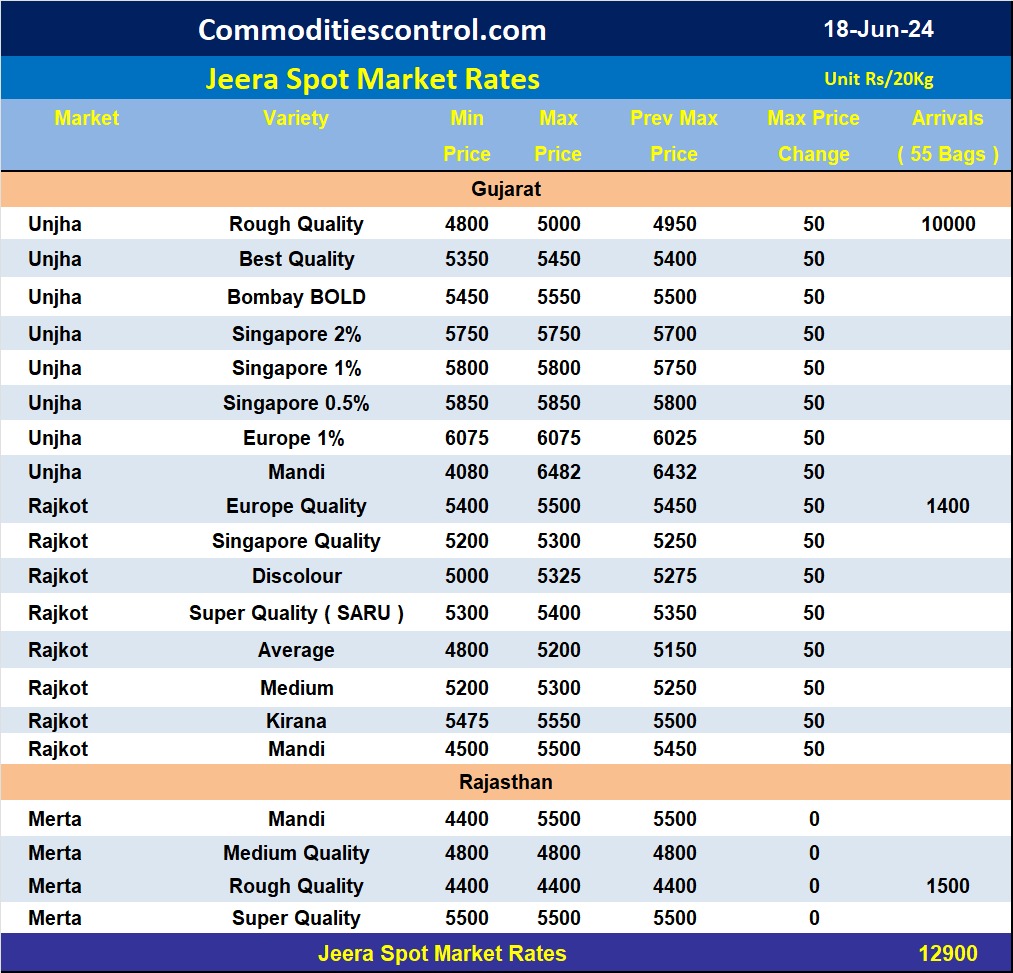

Today, around 10,000 bags of cumin arrived in the Unjha market. Prices for rough quality cumin ranged between Rs 4800-5000 per 20 kg, while the best quality commanded prices of Rs 5350-5450 per 20 kg. Bombay Bold variety traded at Rs 5450-5550 per 20 kg. Across Gujarat, about 17,000 bags of cumin were received, with Rajkot market receiving around 1400 bags priced between Rs 4500-5500 per 20 kg.

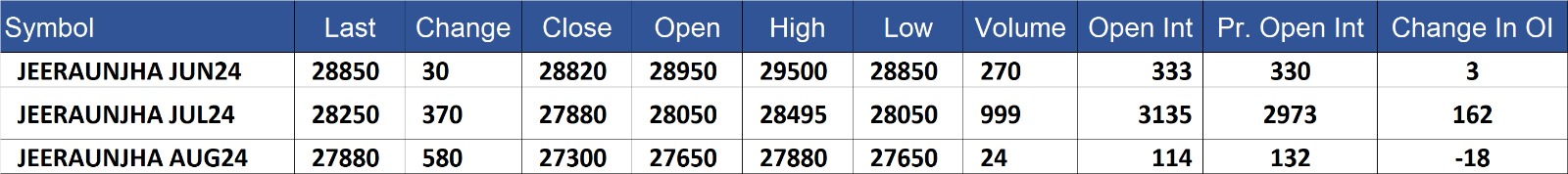

Jeeraunjha contract for JUN delivery settled at Rs 28850/quintal showing an rise of Rs 30 over previous close of Rs 28820/quintal,The contract moved in the range of Rs 28850-29500 for the day. Open interest increased by 3 MT to 333 MT, while trading volume increased by 36 to 270 MT

Jeeraunjha contract for JUL delivery settled at Rs 28250/quintal showing an rise of Rs 370 over previous close of Rs 27880/quintal,The contract moved in the range of Rs 28050-28495 for the day. Open interest increased by 162 MT to 3135 MT, while trading volume decreased by -510 to 999 MT.

Jeeraunjha contract for AUG delivery settled at Rs 27880/quintal showing an rise of Rs 580 over previous close of Rs 27300/quintal,The contract moved in the range of Rs 27650-27880 for the day. Open interest decreased by -18 MT to 114 MT, while trading volume decreased by -9 to 24 MT.

Currently The spread between JUN and JUL contract is 600 Rs/quintal.

Currently The spread between JUL and AUG contract is 370 Rs/quintal.

Currently The spread between JUN and AUG contract is 970 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 18-Jun-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)