Jodhpur, May 20 (Commoditiescontrol): Guar seed and gum prices remained steady in the spot market today amid normal trading activities, while futures for both commodities saw an uptick at the local bourse.

According to market sources, the average price range for guar seed in auctions was quoted between Rs 5000 and Rs 5275 per quintal. In direct sales, guar seed prices were stable at Rs 5500 per quintal. Guar gum prices held firm at Rs 10,900 per quintal in Jodhpur, the benchmark market. The total arrivals were reported at 7800 bags.

In the futures market, guar gum futures for June delivery ended Rs 82 or 0.76% higher, settling at Rs 10,893 per quintal on the National Commodity and Derivatives Exchange (NCDEX). During the session, the contract traded between a low of Rs 10,692 and a high of Rs 10,969 per quintal.

Similarly, guar seed futures for June delivery rose by Rs 23 or 0.46%, closing at Rs 5,525 per quintal on the NCDEX. The session's trading range was between Rs 5,471 and Rs 5,525 per quintal.

The steady prices in the physical market and the gains in futures indicate a balanced demand-supply scenario with market participants anticipating a favorable outlook for guar seed and gum in the near term.

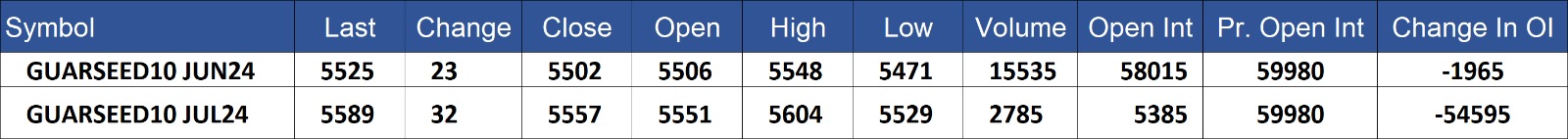

GuarSeed contract for JUN delivery settled at Rs 5525/quintal showing an rise of Rs 23 over previous close of Rs 5502/quintal,The contract moved in the range of Rs 5471-5548 for the day. Open interest decreased by -1965 MT to 58015 MT, while trading volume decreased by -5430 to 15535 MT.

GuarSeed contract for JUL delivery settled at Rs 5589/quintal showing an rise of Rs 32 over previous close of Rs 5557/quintal,The contract moved in the range of Rs 5529-5604 for the day. Open interest decreased by -54595 MT to 5385 MT, while trading volume decreased by -18180 to 2785 MT.

Currently The spread between JUN and JUL contract is -64 Rs/quintal.

GuarGum contract for JUN delivery settled at Rs 10893/quintal showing an rise of Rs 82 over previous close of Rs 10811/quintal,The contract moved in the range of Rs 10692-10969 for the day. Open interest decreased by -1105 MT to 46760 MT, while trading volume increased by 1240 to 8290 MT.

GuarGum contract for JUL delivery settled at Rs 11050/quintal showing an rise of Rs 65 over previous close of Rs 10985/quintal,The contract moved in the range of Rs 10836-11090 for the day. Open interest decreased by -44180 MT to 3685 MT, while trading volume decreased by -3955 to 3095 MT.

Currently The spread between JUN and JUL contract is -157 Rs/quintal.