Jodhpur, May 27 (Commoditiescontrol): Guar seed and gum prices remained largely stable in the physical market on Monday, while futures settled lower amid profit-booking activities. Lackluster trade was observed in guar seed and gum futures, with some profit-taking seen. However, the spot market witnessed normal trade with no significant change in arrivals.

According to market sources, the average price range for guar seed in auctions was quoted at Rs 5000-5250 per quintal. In all paid, guar seed prices were quoted at Rs 5480 per quintal, down Rs 20 per quintal.

Guar gum prices remained flat at Rs 10,900 per quintal in the benchmark market of Jodhpur. Arrivals were reported at 6800 bags.

Guar gum futures for delivery in June ended Rs 110 or 1.02% down at Rs 10,681 per quintal on the NCDEX. The session witnessed a low of Rs 10,650 and a high of Rs 10,851.

Guar seed futures for delivery in June dropped Rs 33 or 0.60% to Rs 5,462 per quintal on the NCDEX. The session saw a low of Rs 5,425 and a high of Rs 5,520.

Traders are anticipating further upside movement in the prices of guar seed and gum in the near term. While spot market activity remains stable, profit-booking in futures has led to a temporary decline in prices. However, market sentiment remains positive, with expectations of price appreciation in the coming sessions.

GuarSeed contract for JUN delivery settled at Rs 5462/quintal showing an fall of Rs -33 over previous close of Rs 5495/quintal,The contract moved in the range of Rs 5425-5520 for the day. Open interest decreased by -1360 MT to 47095 MT, while trading volume decreased by -3225 to 11555 MT

GuarSeed contract for JUL delivery settled at Rs 5517/quintal showing an fall of Rs -44 over previous close of Rs 5561/quintal,The contract moved in the range of Rs 5494-5580 for the day. Open interest increased by 1420 MT to 13830 MT, while trading volume decreased by -535 to 3800 MT.

Currently The spread between JUN and JUL contract is -55 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 27-May-2024, was 22849 MT

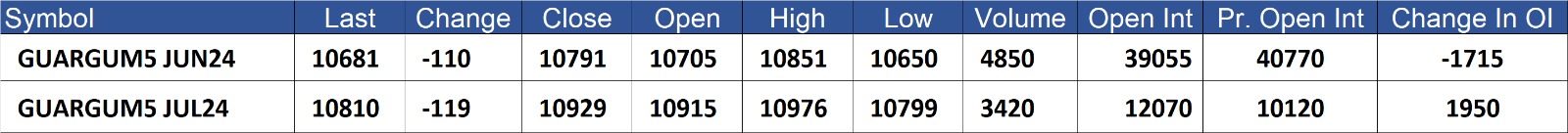

GuarGum contract for JUN delivery settled at Rs 10681/quintal showing an fall of Rs -110 over previous close of Rs 10791/quintal,The contract moved in the range of Rs 10650-10851 for the day. Open interest decreased by -1715 MT to 39055 MT, while trading volume decreased by -435 to 4850 MT.

GuarGum contract for JUL delivery settled at Rs 10810/quintal showing an fall of Rs -119 over previous close of Rs 10929/quintal,The contract moved in the range of Rs 10799-10976 for the day. Open interest increased by 1950 MT to 12070 MT, while trading volume increased by 950 to 3420 MT.

Currently The spread between JUN and JUL contract is -129 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 27-May-2024, was 24153 MT

(By Commoditiescontrol Bureau: +91 9820130172)