Mumbai, 27 June 2024 (Commoditiescontrol): Tur prices in Burmese markets have ended on a steady note after a recent surge, with traders noting significant buying activity driving stability in prices. Across imported markets, lemon prices have maintained a steady to firm stance, particularly rising by Rs 100 per quintal in Delhi. Meanwhile, in various African countries, prices have generally held steady, with Sudan-origin tur witnessing slight increases.

As mentioned in our previous report, the smaller crop yield this season has resulted in limited stocks available with mills and traders, most of whom are adhering to permissible limits. This has helped mitigate significant selling pressure despite regulatory stock limits. Traders with stocks below permissible limits are actively procuring fresh supplies, while sellers are hesitant to sell at current price levels. However, demand for Tur dal remains subdued due to the availability of cheaper alternatives.

In Burmese markets, Tur prices have stabilized duw to purchases from stockists and exporters anticipating price hikes amidst short supplies in India. In CNF India trade, prices have remained eased by USD 15, with sporadic selling.

On the domestic front, lemon Tur prices held steady-to-firm across various markets. Prices in most African countries have advanced, with minimal trading activity reported.

Tur International Prices In Key Indian Markets:

In Maharashtra and Madhya Pradesh, both bilty and mandi prices for tur have surged due to acute scarcity in the supply chain. Limited availability from farmers and stockists has propelled prices upward as buyers capitalize on lower price levels.

Spot Raw Tur Bilty And Mandi Prices In Key Indian Markets:

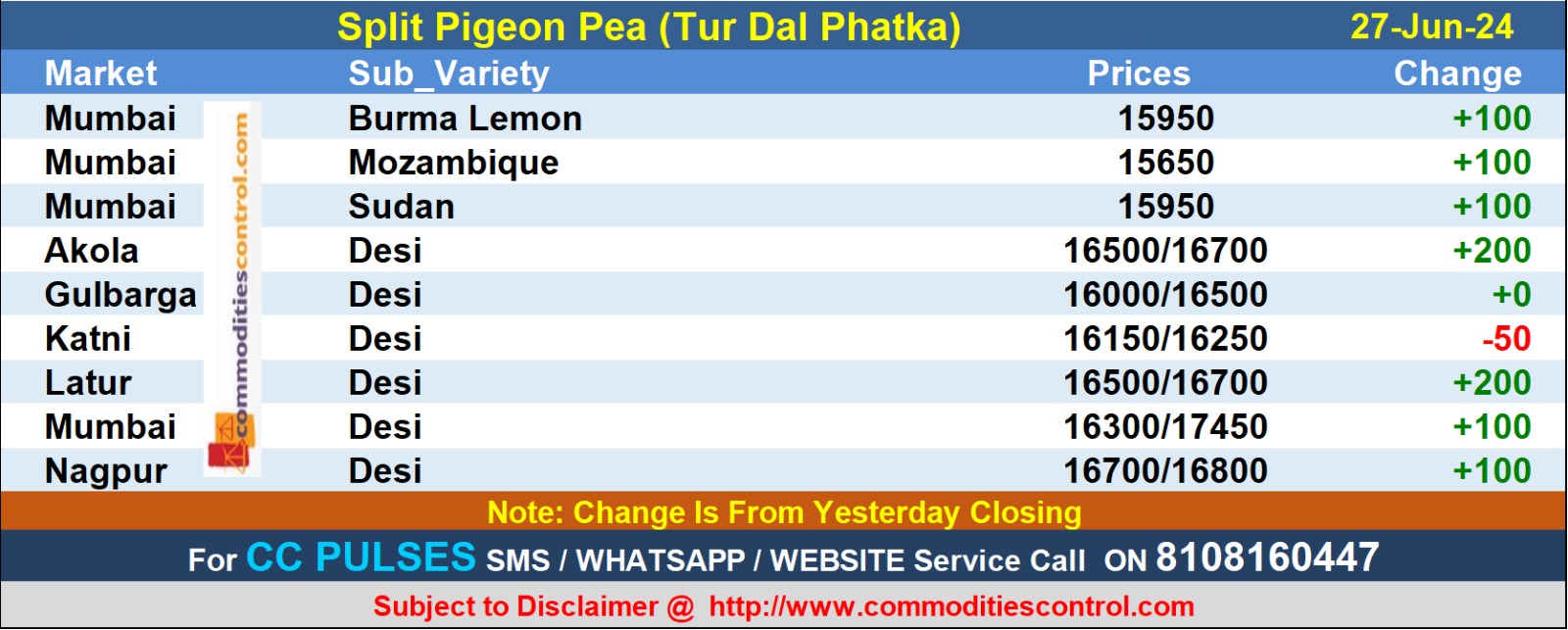

Dal prices, however, displayed mixed trends across major markets. While prices saw upticks in many regions, exceptions like Gulbarga and Katni reported stable to weak prices following previous increases. Market insights suggest average demand for dal, with reports indicating a notable shift among Madhya Pradesh millers towards favoring bolder masur varieties over traditional dal types.

Spot Raw Tur Dal Prices In Key Indian Markets:

As anticipated, slight upward movements were observed in specific market segments. Analysts foresee continued price pressures driven by ongoing supply constraints among farmers, stockists, and millers. Additionally, robust demand for seeds is expected to bolster prices in the near term, reinforcing market stability.Further more recovery in dal prices is expcted to support recovery in Tur prices.

(By Commoditiescontrol Bureau; +91-9820130172)