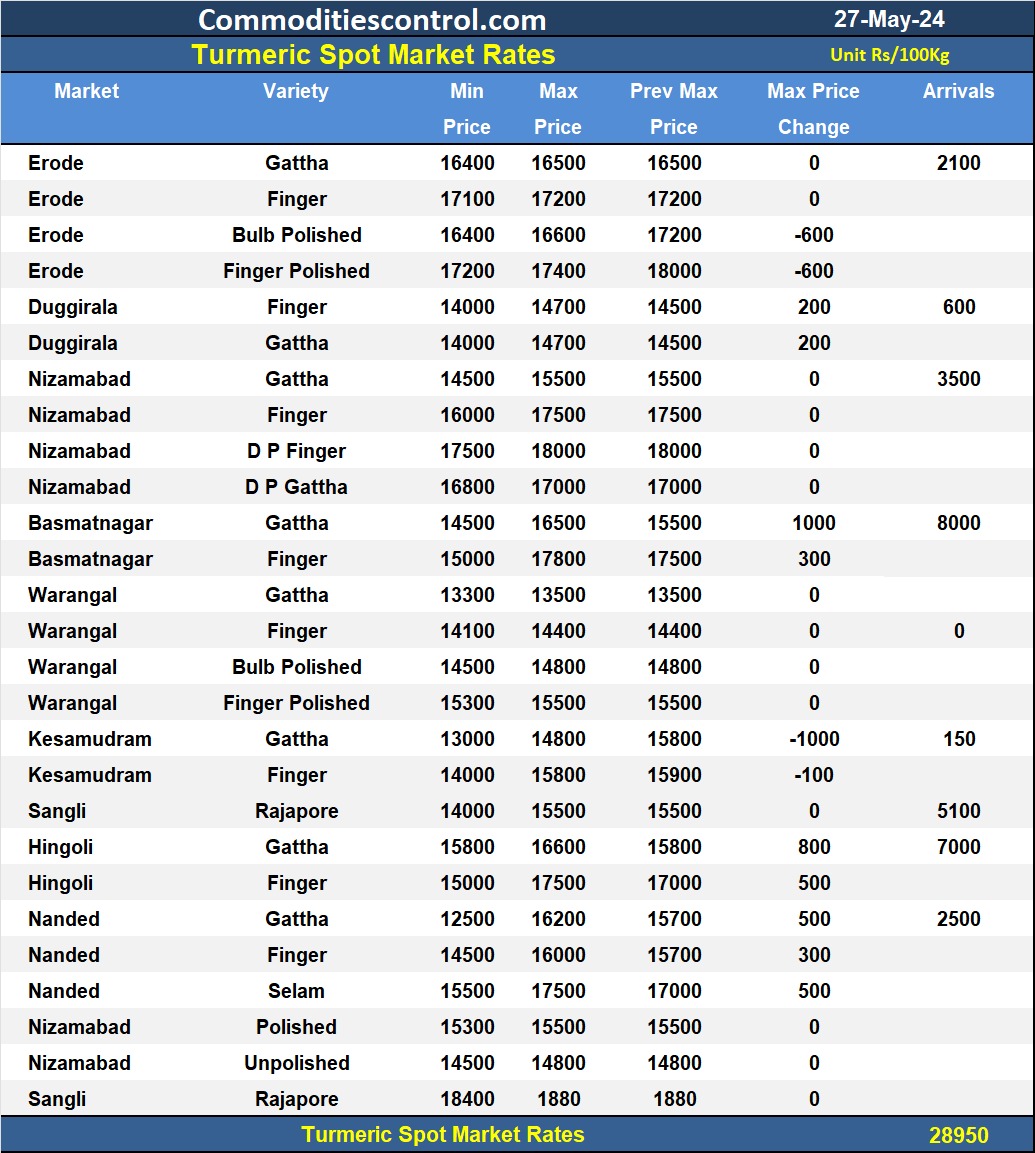

Mumbai, May 27 (CommoditiesControl): Turmeric prices exhibited mixed trends in the spot markets, with a decline in Kesamudram and an increase in Maharashtra. Prices in Maharashtra's major markets rose by Rs 300-800 per quintal, while some markets remained closed over the past week as NCDEX futures prices hit upper circuits.

The arrivals of turmeric bags surged to around 28,950, up from 10,600 bags in the previous session, driven by increased arrivals in Basmatnagar and other markets. Market participants report that this season's production is expected to be 20-25% lower than the previous year, contributing to the mixed price trends.

Turmeric futures prices on the NCDEX market fell marginally after a significant recovery of nearly 10% in the previous week. Local traders indicate that prices are consolidating following this sharp recovery. The June contract declined by 1.1%, while the August contract fell by 0.6%. Despite the recent decline, prices on the NCDEX are expected to rise in the coming days due to strong buying activity.

NCDEX Spot Prices (Rs/Qtl)

- Nizamabad - NCDEX Polished: Rs 18,335

- Nizamabad - NCDEX Unpolished: Rs 17,345

- Sangli - NCDEX Rajapore: Rs 20,303

NCDEX Future Prices (Rs/Qtl)

- June 2024: Rs 19,754 (down by 218, -1.1%)

- August 2024:Rs 20,436 (down by 156, -0.6%)

Turmeric contract for JUN delivery settled at Rs 19754/quintal showing an fall of Rs -218 over previous close of Rs 19972/quintal,The contract moved in the range of Rs 19708-20430 for the day. Open interest decreased by -315 MT to 15535 MT, while trading volume increased by 1075 to 5880 MT.

Turmeric contract for AUG delivery settled at Rs 20436/quintal showing an fall of Rs -156 over previous close of Rs 20592/quintal,The contract moved in the range of Rs 20350-21058 for the day. Open interest increased by 365 MT to 6795 MT, while trading volume increased by 20 to 1965 MT.

Currently The spread between JUN and AUG contract is -682 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)