Ahmedabad, May 27 (CommoditiesControl): The cumin market has experienced a price softening of Rs 150 per 20 kg due to a lack of purchasing from stockists and reduced export demand. In recent days, cumin prices had risen, prompting increased selling by farmers. However, the arrival of cumin in the market has led to a downward trend in prices.

Traders attribute the price decline to low demand from stockists and a reduction in export demand. Exporters explain that during the last financial year, Chinese importers purchased cumin from India at lower prices and re-exported it to India at higher prices. Consequently, China's cumin stock is currently very low, and its domestic crop has been damaged. This situation suggests that China may soon import a significant quantity of cumin from India, potentially improving prices if demand from China materializes.

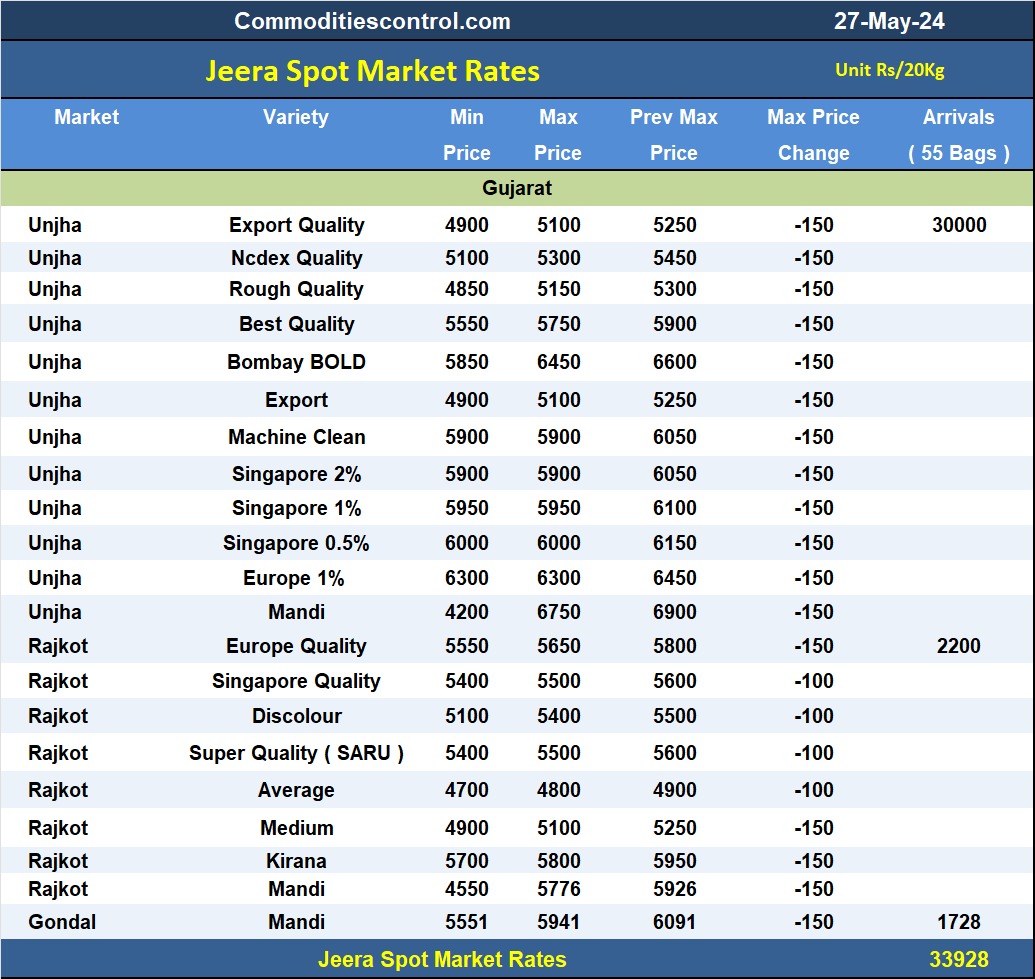

Today, approximately 30,000 sacks of cumin arrived at Unja Mandi. The prices were as follows:

- Rough cumin: Rs 4850-5150 per 20 kg.

- Best quality cumin: Rs 5550-5750 per 20 kg.

- Bombay Bold cumin: Rs 5850-6450 per 20 kg

In Gondal Mandi, the arrival of 1728 bags saw prices ranging from Rs 5551 to Rs 5941 per 20 kg. In Rajkot Mandi, with around 2200 bags arriving, prices were between Rs 4550 and Rs 5776 per 20 kg.

Overall, the cumin market is facing a downward price trend due to low demand, but potential increases in Chinese imports could stabilize or improve prices in the near future.

Jeeraunjha contract for JUN delivery settled at Rs 28500/quintal showing an fall of Rs -890 over previous close of Rs 29390/quintal,The contract moved in the range of Rs 28355-29240 for the day. Open interest decreased by -159 MT to 3009 MT, while trading volume decreased by -531 to 1350 MT.

Jeeraunjha contract for JUL delivery settled at Rs 27680/quintal showing an fall of Rs -940 over previous close of Rs 28620/quintal,The contract moved in the range of Rs 27505-28500 for the day. Open interest increased by 153 MT to 873 MT, while trading volume decreased by -288 to 372 MT.

Jeeraunjha contract for AUG delivery settled at Rs 28620/quintal showing an rise of Rs 120 over previous close of Rs 28500/quintal,The contract moved in the range of Rs 28620-28620 for the day. Open interest was simillar by 0 MT to 3 MT, while trading volume was simillar by 0 to 0 MT.

Currently The spread between JUN and JUL contract is 820 Rs/quintal.

Currently The spread between JUL and AUG contract is -940 Rs/quintal.

Currently The spread between JUN and AUG contract is -120 Rs/quintal

JeeraUnjha stock in NCDEX accredited warehouse as on 27-May-2024, was NA MT.

(By Commoditiescontrol Bureau: +91 9820130172)