Mumbai, June 18 (Commoditiescontrol): Turmeric prices remained mostly firm across the markets today, buoyed by strong buying activity at lower price levels. According to market sources, while buyers and stockists have been cautious, end users have continued to purchase based on their needs. Additionally, lower arrivals have supported spot markets.

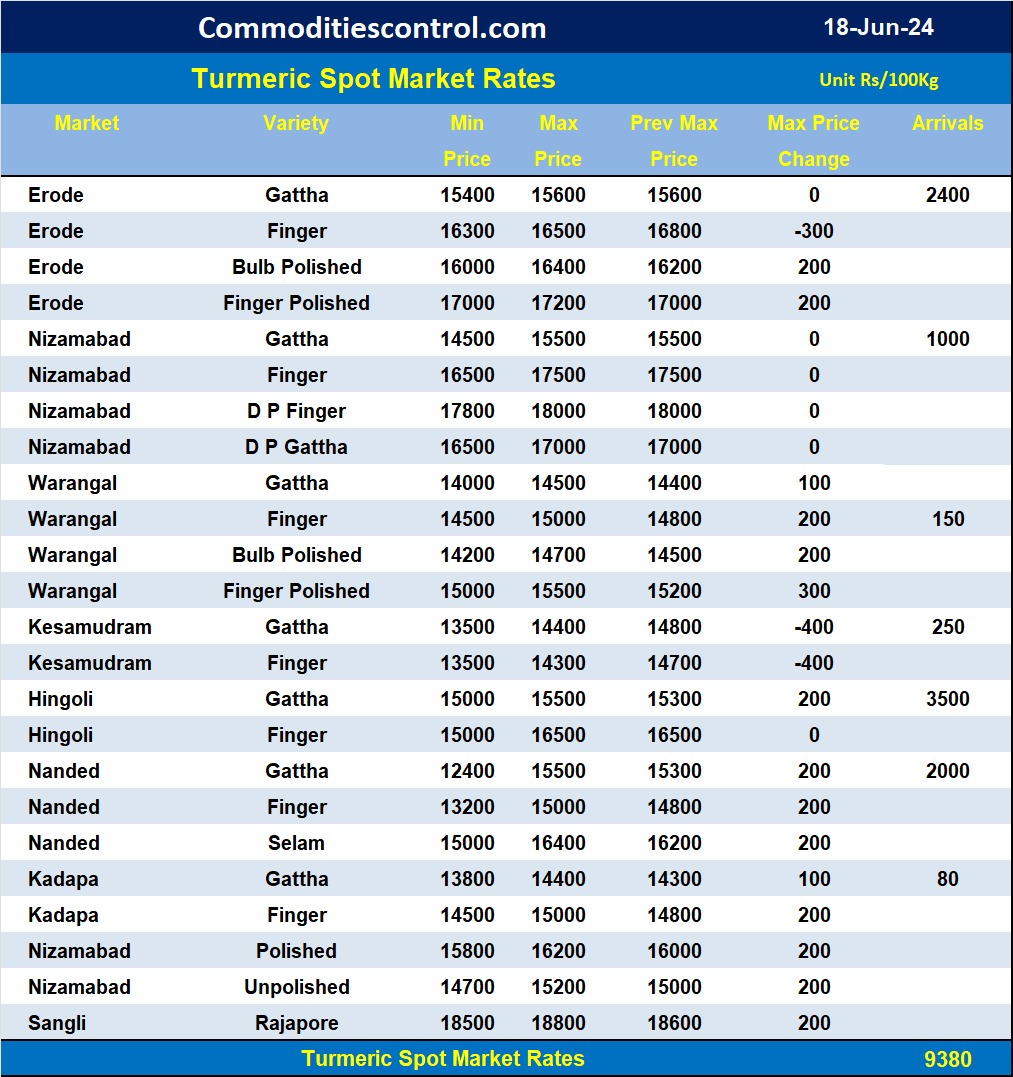

The total arrivals dropped to 9,380 bags from 13,280 in the previous session, with most markets being open today. Market participants anticipate a 20-25% reduction in production this season compared to last year, which is expected to result in lower arrivals throughout the season.

Following a week of range-bound trading, turmeric prices in the NCDEX markets saw a moderate recovery due to strong buying activity. Prices increased by 0.9% in the August contract and 0.8% in the October contract.

NCDEX Spot Prices (Rs/Qtl):

- Nizamabad - NCDEX Polished: 18,233

- Nizamabad - NCDEX Unpolished: 17,323

- Sangli - NCDEX Rajapore: 19,396

NCDEX Future Prices (Rs/Qtl):

- August 2024: 18,340 (up by 160, +0.9%)

- October 2024: 18,996 (up by 154, +0.8%)

Overall, the strong buying interest, combined with reduced arrivals and lower production forecasts, has helped maintain firm spot prices and support the recovery in futures prices.

Turmeric contract for JUN delivery settled at Rs 17900/quintal showing an rise of Rs 474 over previous close of Rs 17426/quintal,The contract moved in the range of Rs 17900-18096 for the day. Open interest decreased by -70 MT to 20 MT, while trading volume increased by 35 to 90 MT.

Turmeric contract for AUG delivery settled at Rs 18340/quintal showing an rise of Rs 160 over previous close of Rs 18180/quintal,The contract moved in the range of Rs 18230-18680 for the day. Open interest increased by 200 MT to 21400 MT, while trading volume increased by 735 to 2820 MT.

Currently The spread between JUN and AUG contract is -440 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)