Mumbai, June 21 (Commodities Control): Turmeric prices in major markets have predominantly weakened, witnessing declines of Rs 300-400 per quintal across most regions except Nanded. Market sources attribute this downturn to cautious buyer sentiment and selective purchasing by end users. Additionally, the significant downturn in NCDEX futures has exerted additional pressure on spot prices.

Arrivals surged to 18,106 bags from 11,000 bags in the previous session, reflecting increased market activity and expanded trading locations. Market participants anticipate a 20-25% reduction in production compared to last year, leading to expectations of lower arrivals throughout the season.

In South India and Maharashtra, major turmeric-growing regions are anticipating active monsoon conditions, which farmers believe will bolster acreage significantly this season.

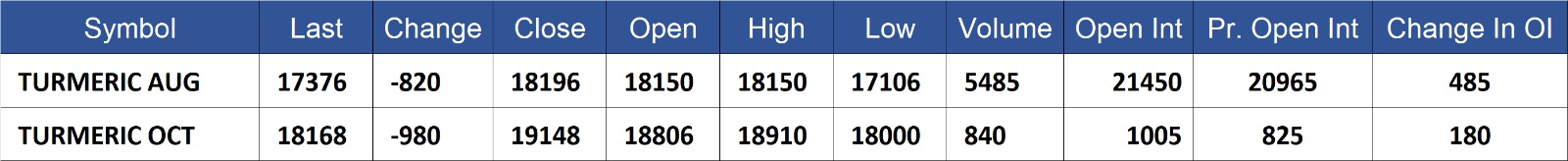

NCDEX futures for turmeric experienced a sharp decline following a brief recovery earlier in the week. Prices fell sharply with August-24 contracts dropping by 4.5% to Rs 17,375 per quintal and October-24 contracts decreasing by 5.1% to Rs 18,168 per quintal.

NCDEX Spot Prices (Rs/Qtl):

- Nizamabad - NCDEX Polished: 18,054

- Nizamabad - NCDEX Unpolished: 16,886

- Sangli - NCDEX Rajapore: 19,117

Overall, the turmeric market currently faces downward pressure amidst increased arrivals, cautious buying patterns, and substantial declines in futures trading, highlighting a challenging scenario for market participants.

.jpeg)

Turmeric contract for AUG delivery settled at Rs 17376/quintal showing an fall of Rs -820 over previous close of Rs 18196/quintal,The contract moved in the range of Rs 17106-18150 for the day. Open interest increased by 485 MT to 21450 MT, while trading volume increased by 3840 to 5485 MT.

Turmeric contract for OCT delivery settled at Rs 18168/quintal showing an fall of Rs -980 over previous close of Rs 19148/quintal,The contract moved in the range of Rs 18000-18910 for the day. Open interest increased by 180 MT to 1005 MT, while trading volume increased by 515 to 840 MT.

Currently The spread between AUG and OCT contract is -792 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)