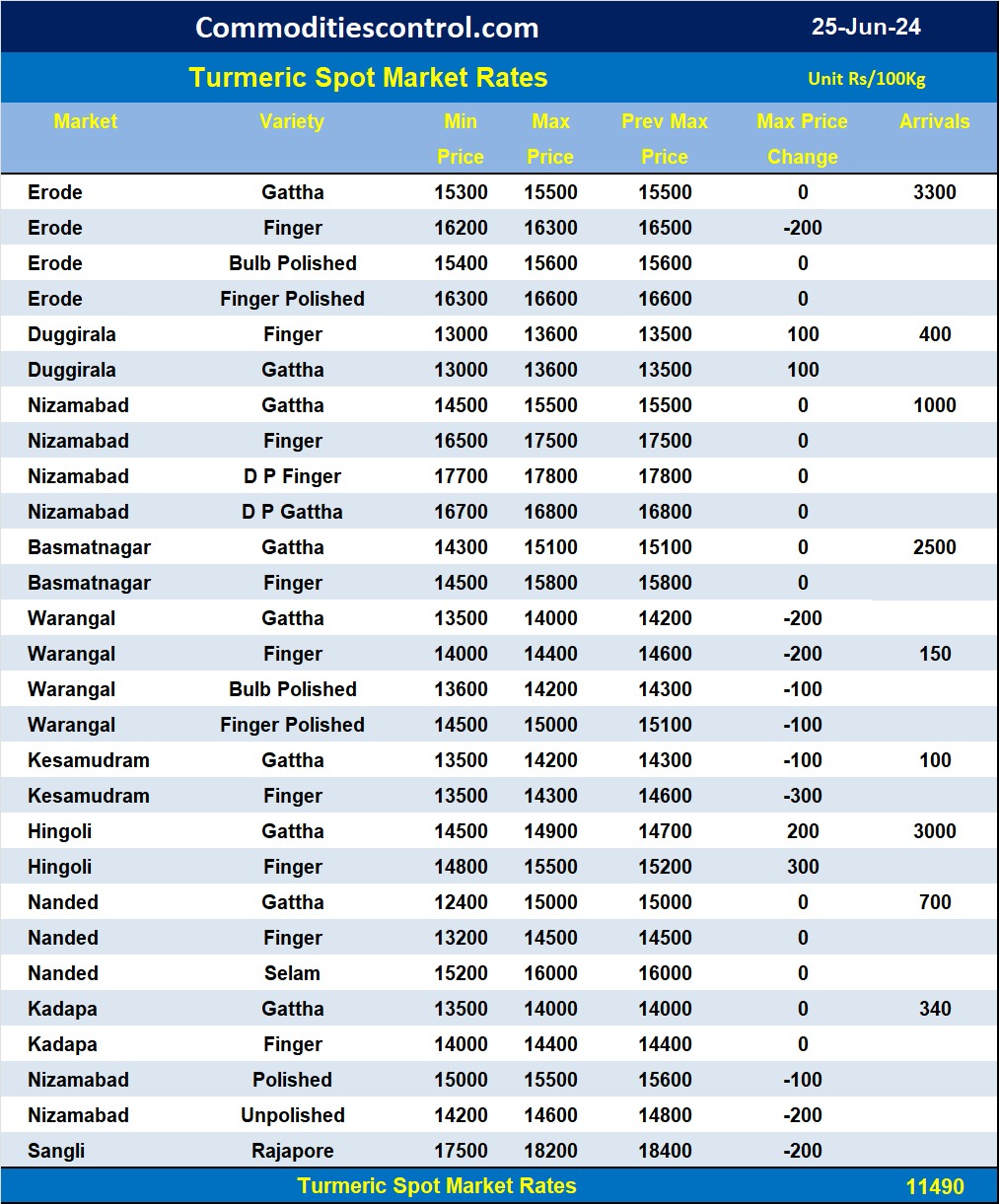

Mumbai, June 25 (CommoditiesControl): Turmeric prices in major markets have been predominantly weak over the past 7-8 sessions, with prices dropping another Rs 100-300 per quintal in all markets except Nizamabad and Cuddapah. Sources indicate that buyers and stockists have been cautious, while end users have continued purchasing based on immediate needs. The sharp decline in the NCDEX markets has also exerted downward pressure on prices.

Arrivals fell to 11,490 bags from 16,673 in the previous session, reflecting a decline across markets. Market participants predict this season's production will be 20-25% lower than last year, leading to overall reduced arrivals.

The monsoon season is currently underway in the primary turmeric-growing regions of South India and Maharashtra. Farmers expect a significant increase in acreage this season.

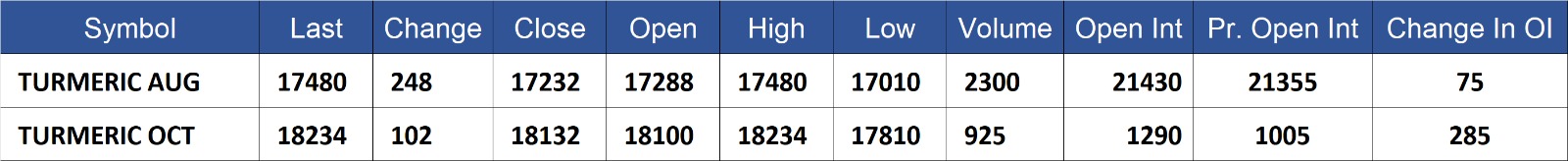

Despite the general downward trend, turmeric prices in NCDEX markets have bucked the trend and shown slight recovery. Prices increased by 1.5% for August contracts and 0.5% for October contracts. However, trader confidence remains low, keeping prices in check.

NCDEX Spot Prices (Rs/Qtl)

- Nizamabad - NCDEX Polished: 17,946

- Nizamabad - NCDEX Unpolished: 17,000

- Sangli - NCDEX Rajapore: 18,804

NCDEX Future Prices (Rs/Qtl)

- August 2024: 17,480 (+248, +1.4%)

- October 2024: 18,234 (+102, +0.5%)

Turmeric contract for AUG delivery settled at Rs 17480/quintal showing an rise of Rs 248 over previous close of Rs 17232/quintal,The contract moved in the range of Rs 17010-17480 for the day. Open interest increased by 75 MT to 21430 MT, while trading volume decreased by -490 to 2300 MT.

Turmeric contract for OCT delivery settled at Rs 18234/quintal showing an rise of Rs 102 over previous close of Rs 18132/quintal,The contract moved in the range of Rs 17810-18234 for the day. Open interest increased by 285 MT to 1290 MT, while trading volume increased by 505 to 925 MT.

Currently The spread between AUG and OCT contract is -754 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)