Mumbai, July 3 (CommoditiesControl): Turmeric spot prices have shown mixed trends across various markets, while NCDEX futures prices have started to decline once again following a brief period of recovery.

In the NCDEX markets, turmeric futures prices have dropped by 2.1% in August contracts and 1.5% in October contracts. Over the past month, prices have decreased by 4,300 points, although this decline may soon stabilize. Strong support is observed around the 15,800 level, with potential for recovery from these levels. However, if the market experiences a breakdown, another decline of approximately 1,500 points could be anticipated.

In the spot markets, turmeric prices were weak overall. Significant drops were noted in Sangli, Warangal, Kesamudram, and Kadapa, while Basmatnagar saw a price increase. Other markets remained stable. Traders report that buyers and stockists are operating with minimal inventory, and the ongoing price decline may lead stockists to liquidate their holdings, exerting additional pressure on spot market prices. Additionally, reduced demand from Bangladesh is contributing to the downward trend in prices.

Arrivals in the turmeric markets have risen to 12,732 bags from 8,150 in the previous session, with all markets operational today. The onset of the monsoon season in South India and Maharashtra, key turmeric-growing regions, is expected to significantly increase acreage this season, as reported by farmers.

NCDEX Spot Prices (Rs/Qtl):

- Nizamabad - NCDEX Polished: 17,411

- Nizamabad - NCDEX Unpolished: 16,700

- Sangli - NCDEX Rajapore: 18,510

NCDEX Future Prices (Rs/Qtl):

- Aug-24: 16,100 (-344, -2.1%)

- Oct-24: 16,984 (-264, -1.5%)

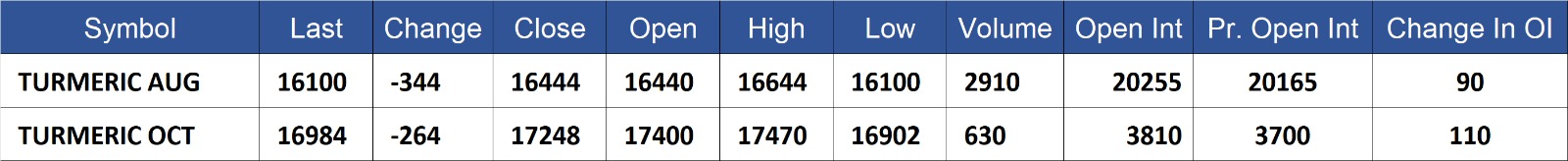

Turmeric contract for AUG delivery settled at Rs 16100/quintal showing an fall of Rs -344 over previous close of Rs 16444/quintal,The contract moved in the range of Rs 16100-16644 for the day. Open interest increased by 90 MT to 20255 MT, while trading volume decreased by -385 to 2910 MT.

Turmeric contract for OCT delivery settled at Rs 16984/quintal showing an fall of Rs -264 over previous close of Rs 17248/quintal,The contract moved in the range of Rs 16902-17470 for the day. Open interest increased by 110 MT to 3810 MT, while trading volume decreased by -760 to 630 MT.

Currently The spread between AUG and OCT contract is -884 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)