New Delhi, September 16 (CommoditiesControl): Mentha oil prices continued to fall on Monday due to weak demand in both domestic and overseas markets. A market analyst attributed the ongoing price decline to subdued demand for natural mentha from industries.

In the physical market, mentha oil prices in Chandausi dropped by ₹6, bringing the price range to ₹1,002-1,004 per kg. Similarly, in Barabanki, prices fell by ₹5, reaching ₹960 per kg.

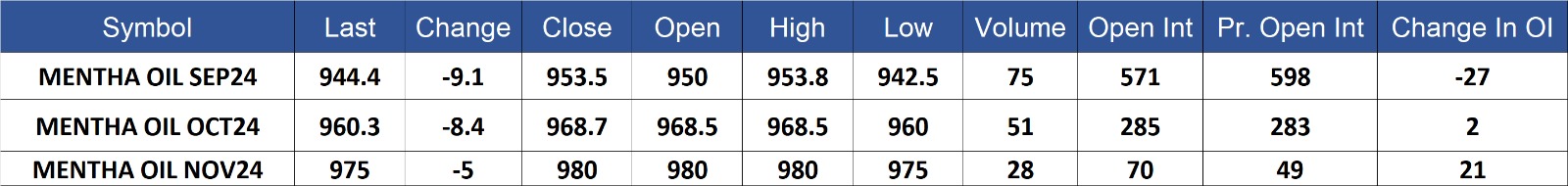

On the futures front, the September contract for mentha oil on the Multi Commodity Exchange (MCX) saw a decline of ₹9.1, settling at ₹944.4 per kg, with an open interest of 571 and a volume of 75. The October contract also experienced a drop of ₹8.40, closing at ₹960.4 per kg, with an open interest of 285 and a volume of 51.

With demand remaining sluggish, prices are likely to remain under pressure unless there is a notable recovery in market demand.

Mentha Oil contract for SEP delivery settled at Rs 944.4/quintal showing an fall of Rs -9.1 over previous close of Rs 953.5/quintal,The contract moved in the range of Rs 942.5-953.8 for the day. Open interest decreased by -27 MT to 571 MT, while trading volume increased by 18 to 75 MT.

Mentha Oil contract for OCT delivery settled at Rs 960.3/quintal showing an fall of Rs -8.4 over previous close of Rs 968.7/quintal,The contract moved in the range of Rs 960-968.5 for the day. Open interest increased by 2 MT to 285 MT, while trading volume increased by 27 to 51 MT.

Mentha Oil contract for NOV delivery settled at Rs 975/quintal showing an fall of Rs -5 over previous close of Rs 980/quintal,The contract moved in the range of Rs 975-980 for the day. Open interest increased by 21 MT to 70 MT, while trading volume increased by 14 to 28 MT.

Currently The spread between SEP and OCT contract is -15.9 Rs/quintal.

Currently The spread between OCT and NOV contract is -14.7 Rs/quintal

Currently The spread between SEP and NOV contract is -30.6 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)