Mumbai, March 28 (Commodities Control): Turmeric prices faced continued weakness in both spot markets and NCDEX futures, reflecting subdued demand and trading activity.

In major spot markets, turmeric prices remained weak due to low demand at prevailing price levels, exacerbated by reduced trading activity as the financial year drew to a close. While domestic demand was reported to be robust, export demand remained sluggish. Notably, a sharp decline in arrivals in Nizamabad contributed to price reductions.

Despite strong domestic demand post a recent price drop, trading activity remained sluggish due to year-end closing activities and the Holi festival. Export inquiries were reported, indicating potential price upticks in the future.

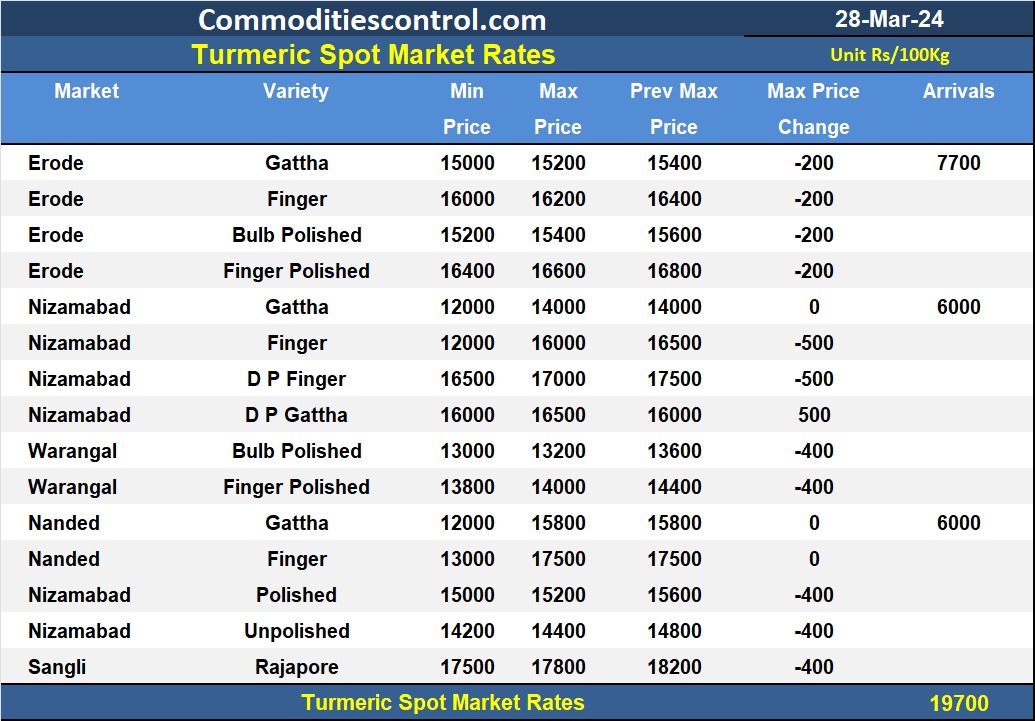

Arrivals plummeted to 19,700 bags from the previous session's 35,500 bags, primarily due to reduced arrivals in Nizamabad and Erode, coupled with market closures in Maharashtra. Erode reported 7,700 bags, followed by Nizamabad and Nanded with 6,000 bags each. Arrivals were notably 20-30% lower than anticipated due to significantly reduced output.

In the NCDEX futures market, turmeric prices experienced a decline following steady trading. Prices dropped by 1.3% in the June contract and 2.5% in the August contract.

Meanwhile, according to the Ministry of Commerce's EXIM data for January, exports fell by 16% to 10,491 MT, primarily due to lower exports from Bangladesh and Iran. However, imports surged by 27.8%, totaling 1,125 MT.

NCDEX Spot (RS/Qtl):

- Nizamabad - NCDEX Polished: 16,659

- Nizamabad - NCDEX Unpolished: 15,920

- Sangli - NCDEX Rajapore: 18,360

NCDEX Future (RS/Qtl):

- Jun-24: 17,650 (-232, -1.3%)

- Aug-24: 17,434 (-448, -2.5%)

Turmeric contract for APR delivery settled at Rs 17150/quintal showing an fall of Rs -270 over previous close of Rs 17420/quintal,The contract moved in the range of Rs 16800-17580 for the day. Open interest decreased by -515 MT to 13515 MT, while trading volume increased by 1970 to 3730 MT.

Turmeric contract for JUN delivery settled at Rs 17650/quintal showing an fall of Rs -232 over previous close of Rs 17882/quintal,The contract moved in the range of Rs 17380-18024 for the day. Open interest increased by 585 MT to 5540 MT, while trading volume increased by 575 to 1275 MT.

Currently The spread between APR and JUN contract is -500 Rs/quintal.

.jpeg)

(By Commoditiescontrol Bureau: +91 9820130172)