Mumbai, 12 Apr 2024 (Commoditiescontrol):Tur prices across major Indian markets exhibited stability with a downward bias due to profit booking at higher prices. Trade sources indicate that stockists are liquidating their inventories in response to recent government directives. Additionally, a decline in demand from mills is further contributing to the weakening of bilty and mandi prices.

Despite the general decline, prices in the Nagpur market bounced back by Rs 100 per quintal after experiencing a significant drop yesterday. This recovery is attributed to reduced selling activity at lower price points.

Imported Tur prices from Africa displayed either stability or slight declines, while lemon Tur prices from Burma dropped by Rs 50 per quintal throughout various markets. Interestingly, local market prices in Burma and CNF prices remained unchanged ahead of market clousure for Water festival. However, African-origin Tur continued to trade more firmly tracking firm trend in desi Tur in Maharashtra markets.

Tur International Prices In Key Indian Markets:

In bilty and mandi trade price recovered in Nagpur after yesterdays sharp fall due to lack of selling interest at lower prices.Similarly Akola bilty prices recovered some of the yesterdays losses.However Indore price declined in response to yesterdays fall in Maharashtra markets.

In mandi trade Nagpur prices recovred after yesterdays fall.While latur price declined by Rs 200/quintal.

Spot Raw Tur Bilty And Mandi Prices In Key Indian Markets:

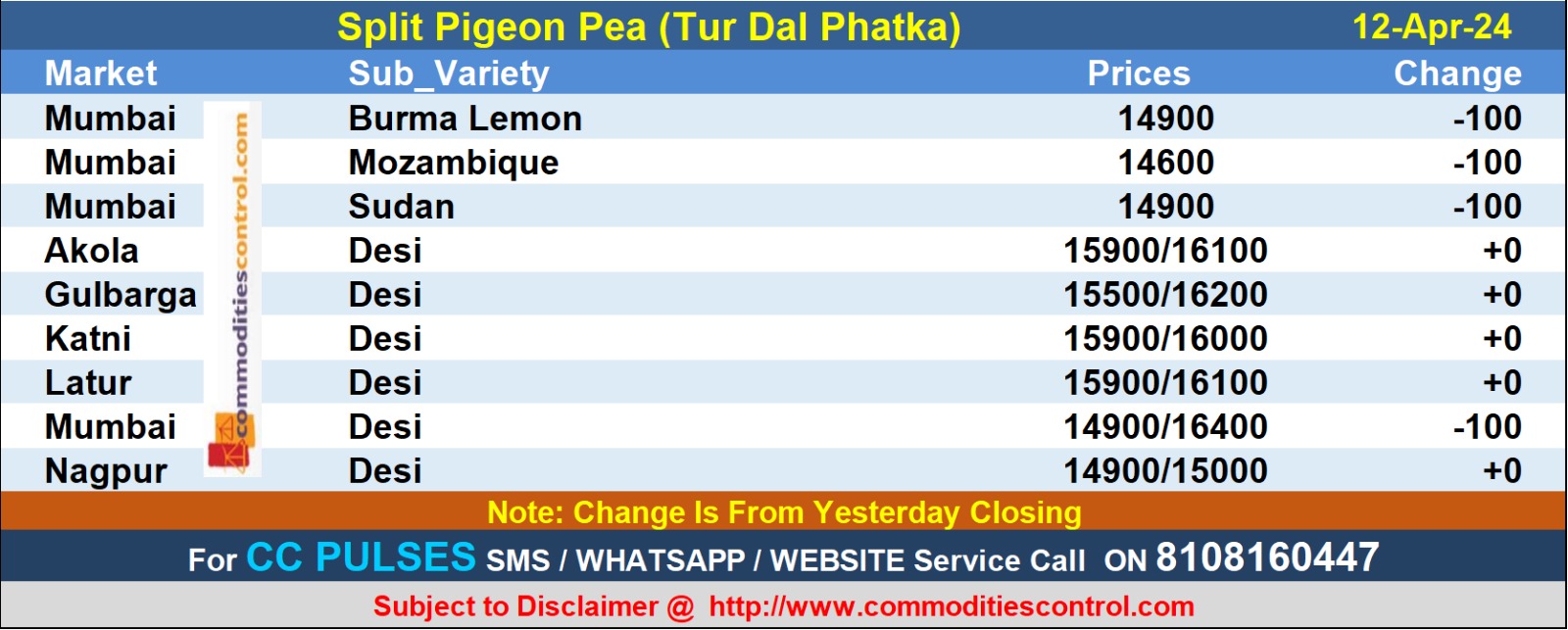

Imported and desi Tur dal price declined in Mumbai market however in other market price remained steady.

Spot Raw Tur Dal Prices In Key Indian Markets:

Tur prices may remain under pressure due to stockists and mills reducing their exposure in response to the government directive to disclose stock levels. This could lead to increased selling activity. Additionally, the directive may discourage speculative buying, potentially halting the ongoing rally. The ample supply of masur and matar will also limit major gains in Tur prices. However, this season's smaller crop size should prevent any drastic price declines.

(By Commoditiescontrol Bureau; +91-9820130172)