Jodhpur, April 19 (Commoditiescontrol): Guar seed and gum prices experienced a decline on Friday due to profit-booking activities. The drop in prices was observed in both the physical market and futures, following a recent sharp increase. Traders noted that prices had surged significantly in the past few sessions, prompting profit-taking.

According to market sources, the average price range for guar seed in auctions was quoted at Rs 5000-5200 per quintal. Guar seed prices saw a decline of Rs 25-30 per quintal, while gum prices dropped by Rs 100-150 per quintal.

In overall trades, guar seed prices were also reported at Rs 5500 per quintal, while guar gum prices stood at Rs 11,000 per quintal in the benchmark market of Jodhpur. Today's arrivals were recorded at 6000 bags.

On the NCDEX, guar gum futures for May delivery concluded Rs 110 or 1% down at Rs 10,945 per quintal, with session lows and highs at Rs 10,930 and Rs 11,125 respectively. Similarly, guar seed futures for April delivery settled Rs 50 or 0.90% down at Rs 5,512 per quintal, with session lows and highs at Rs 5,511 and Rs 5,595 respectively.

Overall, the decline in guar seed and gum prices reflects the impact of profit-booking activities following a period of sharp increases in the market.

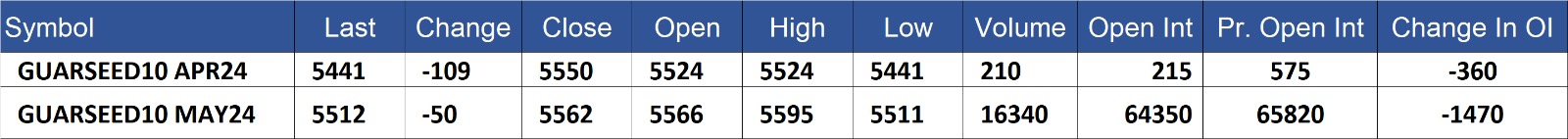

GuarSeed contract for APR delivery settled at Rs 5441/quintal showing an fall of Rs -109 over previous close of Rs 5550/quintal,The contract moved in the range of Rs 5441-5524 for the day. Open interest decreased by -360 MT to 215 MT, while trading volume decreased by -235 to 210 MT.

GuarSeed contract for MAY delivery settled at Rs 5512/quintal showing an fall of Rs -50 over previous close of Rs 5562/quintal,The contract moved in the range of Rs 5511-5595 for the day. Open interest decreased by -1470 MT to 64350 MT, while trading volume decreased by -2425 to 16340 MT.

Currently The spread between APR and MAY contract is -71 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 19-Apr-2024, was 33061 MT

GuarGum contract for APR delivery settled at Rs 11143/quintal showing an rise of Rs 312 over previous close of Rs 10831/quintal,The contract moved in the range of Rs 11143-11143 for the day. Open interest decreased by -20 MT to 430 MT, while trading volume increased by 255 to 400 MT.

GuarGum contract for MAY delivery settled at Rs 10945/quintal showing an fall of Rs -110 over previous close of Rs 11055/quintal,The contract moved in the range of Rs 10930-11125 for the day. Open interest decreased by -885 MT to 45410 MT, while trading volume decreased by -760 to 7580 MT.

Currently The spread between APR and MAY contract is 198 Rs/quintal

GuarGum stock in NCDEX accredited warehouse as on 19-Apr-2024, was 25282 MT

(By Commoditiescontrol Bureau: +91 9820130172)