Mumbai, April 27 (Commodities Control) - The Indian soybean market is facing a notable decrease in arrivals, with the stability of plant rates being cited as a contributing factor.

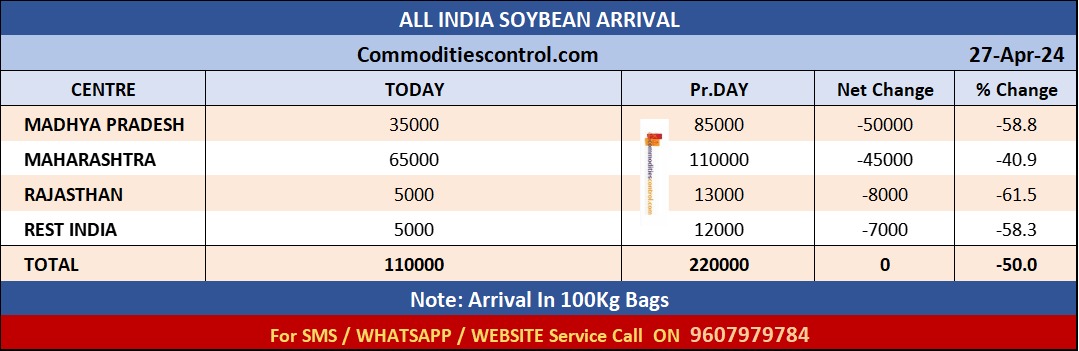

Total soybean arrivals nationwide have reached 110,000 bags, with Madhya Pradesh, the primary soybean producer in the nation, contributing 35,000 bags. Maharashtra reported a substantial arrival of 65,000 bags, while Rajasthan contributed 5,000 bags. The remaining states collectively accounted for an additional 5,000 bags in cumulative arrivals.

Across various mandis in the country, soybean prices have displayed regional variations. In Madhya Pradesh, prices ranged from Rs 4,450 to Rs 4,650 per quintal. Maharashtra observed fluctuations with prices oscillating between Rs 4,400 and Rs 4,550 per quintal, while Rajasthan reported prices ranging from Rs 4,450 to Rs 4,575 per quintal.

Examining soybean plant prices, Madhya Pradesh reported prices in the range of Rs 4,675 to Rs 4,775 per quintal. Maharashtra showcased variability, with plant prices fluctuating between Rs 4,675 and Rs 4,750 per quintal. In Rajasthan, plant prices were recorded in the range of Rs 4,700 to Rs 4,750 per quintal.

(1).jpeg)

Industry analysts suggest that the stability in plant rates has led to a decline in soybean arrivals as farmers may be waiting for more favorable pricing conditions before bringing their produce to the market. The situation underscores the delicate balance between supply and demand dynamics in the Indian soybean market, with implications for both farmers and consumers alike.

(By Commoditiescontrol Bureau: +91-98201 30172)