Jodhpur, May 6 (Commoditiescontrol): Today, the spot market for guar seed and gum remained relatively stable, with prices showing minimal fluctuations, while futures contracts witnessed a downward trend. Improved activities were observed in the spot market, with demand remaining steady at current levels. Additionally, declining stocks of guar seed contributed to the support of its prices, according to trade analysts.

Market sources reported that the average price range for guar seed in auctions was quoted at Rs 5000-5250 per quintal. Moreover, in all paid transactions, guar seed prices were noted at Rs 5400 per quintal. Meanwhile, guar gum prices stood at Rs 10,900 per quintal in the benchmark market of Jodhpur, with arrivals totaling 7000 bags.

On the futures front, guar gum contracts for delivery in May concluded Rs 87 or 0.81% lower at Rs 10,700 per quintal on the NCDEX. The session witnessed a range between Rs 10,626 and Rs 10,821.

Similarly, guar seed futures for delivery in May settled Rs 9 or 0.17% down at Rs 5,401 per quintal on the NCDEX. The trading session saw a low of Rs 5,368 and a high of Rs 5,425.

GuarSeed contract for MAY delivery settled at Rs 5401/quintal showing an fall of Rs -9 over previous close of Rs 5410/quintal,The contract moved in the range of Rs 5368-5425 for the day. Open interest decreased by -5355 MT to 32105 MT, while trading volume increased by 75 to 13140 MT.

GuarSeed contract for JUN delivery settled at Rs 5471/quintal showing an fall of Rs -14 over previous close of Rs 5485/quintal,The contract moved in the range of Rs 5441-5502 for the day. Open interest increased by 3675 MT to 37325 MT, while trading volume increased by 1620 to 14620 MT.

Currently The spread between MAY and JUN contract is -70 Rs/quintal.

GUARSEED stock in NCDEX accredited warehouse as on 06-May-2024, was 28780 MT

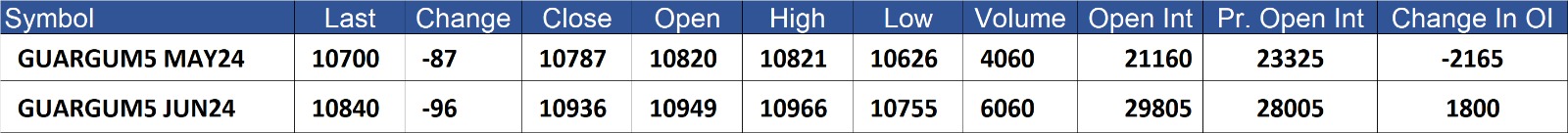

GuarGum contract for MAY delivery settled at Rs 10700/quintal showing an fall of Rs -87 over previous close of Rs 10787/quintal,The contract moved in the range of Rs 10626-10821 for the day. Open interest decreased by -2165 MT to 21160 MT, while trading volume decreased by -1290 to 4060 MT.

GuarGum contract for JUN delivery settled at Rs 10840/quintal showing an fall of Rs -96 over previous close of Rs 10936/quintal,The contract moved in the range of Rs 10755-10966 for the day. Open interest increased by 1800 MT to 29805 MT, while trading volume decreased by -770 to 6060 MT.

Currently The spread between MAY and JUN contract is -140 Rs/quintal.

GuarGum stock in NCDEX accredited warehouse as on 06-May-2024, was 25205 MT

(By Commoditiescontrol Bureau: +91 9820130172)