Mumbai, 1 April (Commoditiescontrol):

Malaysian palm oil futures settled firm on Monday mirroring gains in rival oils and bullishness from the Malaysian palm oil export estimates for March.

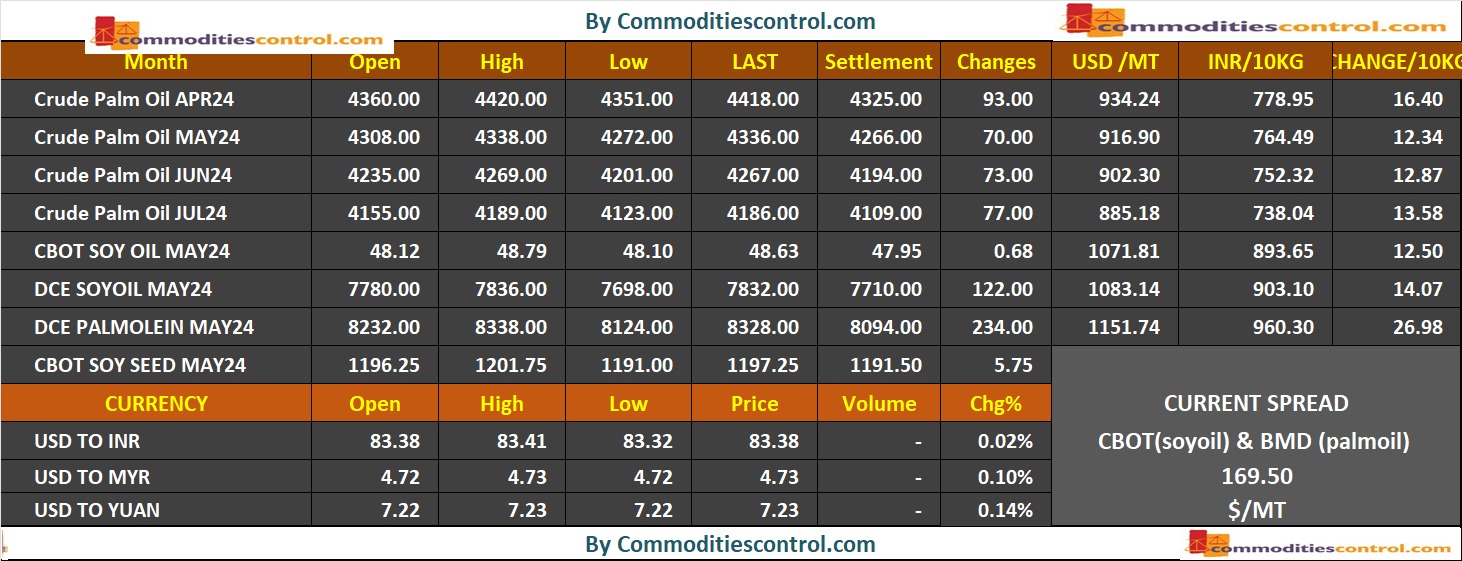

The benchmark palm oil contract for June delivery on the Bursa Malaysia Derivatives (BMD)Exchange increased 72 ringgit, or 1.72%, to 4,266 ringgit ($902.48) a metric ton on the closing.

"The CPO futures were seen trading higher supported by a rally of Palm olein and Soyoil at Dalian Commodity Exchange, Rapeseed oil at Zhengzhou Commodity Exchange, along with bullish momentum in Soyoil at the Chicago Board of Trade," a local research analyst said.

The additional bullishness also came from the Malaysian palm oil export estimates for March, he added.

The soyoil contract on the Dalian Commodity Exchange gained 1.58%, while its palm oil contract increased 2.89%. Soyoil prices on the Chicago Board of Trade rose 1.29%.

Palm oil is affected by price movements in related oils as they compete for a share of the global vegetable oils market.

Amspec Agri said exports of Malaysian palm oil products for March are seen at 1,292,130 metric tons.

According to cargo surveyor Intertek Testing Services (ITS), it rose 20.5% to 1,333,138 metric tons from 1,106,054 metric tons shipped during February.

Crude oil prices added to recent gains on Monday amid expectations of tighter supply from OPEC+ cuts and attacks on Russian refineries while upbeat Chinese manufacturing data supported the outlook for improving demand.

Stronger crude oil futures make palm a more attractive option for biodiesel feedstock.

The Malaysian ringgit depreciated slightly against the dollar.