MUMBAI (Commoditiescontrol) - As predicted in the last week’s report (23rd May,2015), cotton moved easy for most of the sessions in the week ending 30th May, 2015. Demand in the fibre remained subdued and most of the mills and spinners maintained wait and watch approach anticipating further correction in prices. Muted demand in cotton yarn coupled with the prolonged liquidity crunch faced by the Indian textile industry slowed down the whole business chain. Cotton yarn prices witnessed correction of around Rs. 1-3/kg during the week due to weak demand from domestic and overseas buyers.

Negligible demand in cotton seed oil cake (CoC) and cotton seed also added woes to the bearish tone in the soft commodity.

Forecasts of timely onset of monsoon makes it certain that sowing of the next crop would be on time, raising the chances of arrival of next crop in market yards on time. This factor has also dampened market sentiments. As per our markets sources, sowing has already kick-started in many major producing regions and is in full-swing. As per the government of India, cotton has been planted in around 8.82 lakh hectares as on 29th May,2015 compared to 7.72 lakh ha last year.

However, the market gave up the continuous weakness later in the week and moved slightly upward as textile mills entered markets to source the fibre. Market sources said that the constant fall in prices seemed to have attracted mills and spinners.

That apart, predictions by several weather forecasters suggesting onset of this year’s monsoon to be weaker than normal, though to be on time, has also evoked concerns of impacting yield for the upcoming crop. This news has alerted sellers and made pulled them away from releasing their stocks in markets.

Extreme short supply of the fibre across the country also forced mills and spinners to come forward and inquire. The Cotton Corporation of India (CCI) has estimated all India cotton arrivals at 348.37 lakh bales as on 18th May during the current season started in 1st October, 2014. Last year same time, arrivals were at 364.48 lakh bales. Of the total estimated arrivals, north India received around 47.52 lakh bales compared to 59.50 lakh bales last year, the government nodal agency said. Central markets saw supply of around 181.18 lakh bales compared to 198.32 lakh bales last year, while arrivals of around 114.23 lakh bales have been recorded in southern Indian markets compared to100.77 lakh bales last year. According to traders, all India cotton arrivals as on 30th May is estimated at around 352.50 lakh bales.

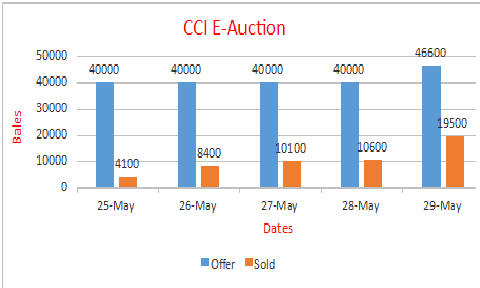

Besides, private traders have very limited unsold stocks of around 20 lakh bales left with them, which they could hold onto at the moment and release in a slow manner during the rest of the season. On the other hand, government agencies have huge unsold stocks with them. The Maharashtra Cotton Federation has unsold stock of around 4.23 lakh bales left, while the Cotton Corporation of India (CCI) is sitting with nearly 75 lakh bales of cotton. It has been receiving lukewarm response at its E-auctions for most of the sessions in the week. But then, the agency had said that it will not sell its stocks at reduced rates even if it could not sell its stocks this season. It said it will keep its stocks for the next year as carry-over stock.

The CCI has procured around 87 lakh bales of cotton so far this season. While it has sold nearly 11.08 lakh bales till date, as per a latest report. The Maharashtra Federation has procured about 86 lakh bales of cotton so far, while it sold around 10.971 lakh bales.

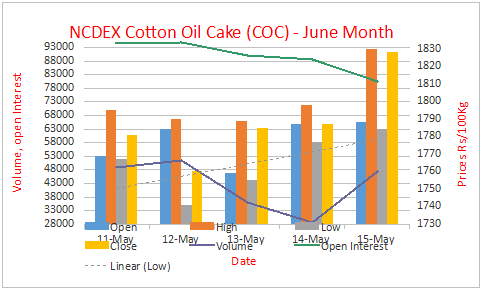

Weakness In Cotton Seed Oilcake Unlikely (Special Coverage)

MUMBAI (Commoditiescontrol) - Cotton seed cake prices dropped around 10 percent during the last 15 days. In the wake of this downfall, there are talks of further fall in prices with the onset of monsoon or lower availability of cotton seed.

The India Meteorological Department (IMD) had predicted that monsoon would arrive two days ahead of the schedule. If the onset of monsoon is timely, cotton seed cake would come further under pressure. But if it gets delayed or weaker, chances of prices falling further are less. Click Here For Full Story

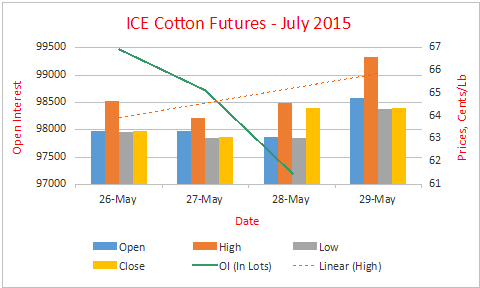

On international markets also, cotton may trade sideways in the sessions to come as total open interest on International Cotton Exchange (ICE) cotton futures reduced 5,595 contracts to 188,827 contracts. Total on-call sales on all active futures decreased 1,104 contracts to 57,079 and total purchases Increased 507 to 23,774 contracts. Over all on-call sales seen moving sideways on ICE. Participants have been covering up their positions and open interest is decreasing, it is a sign that participants are covering their short positions. The movement in overseas markets also sent positive signals to the domestic markets. Click Here For Story.

Further, the domestic cotton markets tracked strong signals from the U.S. After the USDA released its weekly export sales data yesterday showing net export sales of upland cotton reached 117,500 running bales in the week ending May 21, nearly double from the previous week and up 86 percent from the previous four-week average.

Stock Position At Exchange Warehouses

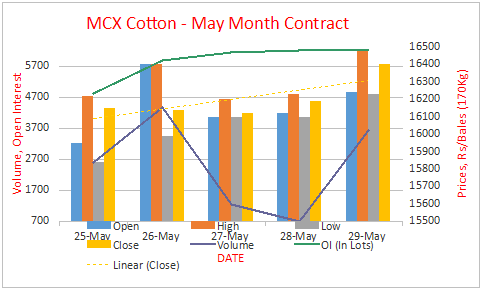

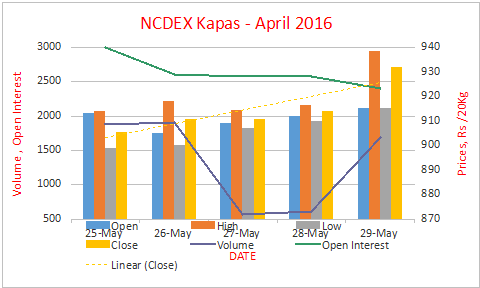

Cotton stocks at National Commodity and Derivatives Exchange (NCDEX) accredited warehouses remained unchanged at 400 bales as on 28th May, 2015. Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses stood at 1,02,100 bales as on 28th May, down 7,500 bales from 1,09,600 bales as on 22nd May.

NCDEX, MCX Weekly Update

MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas Weekly Technical Update. Click Here

NCDEX CoC Weekly Technical Update. Click Here

Cotton Price Settlement On MCX As On 29 May, 2015

Cotton final settlement prices of MXC contracts which expired on 29 May, 2015 stood at Rs. 16,520.00/bales. Meanwhile, prices of kapas khali (CoC) settled at Rs. 1,862.50/100kg.

U.S. Market Through The Week

Cotton futures on Intercontinental Exchange (ICE) posted weekly gain of 1.65 percent, thanks to weaker dollar, strong weekly export sales data and slow planting in U.S. The most-active July cotton contract traded mostly lower through the week, but weakness in dollar index on Thursday followed by strong weekly export data spurred prices to near two week high.

The dollar index was down 0.27 percent on Thursday, while net export sales for the week ended May 21 were 117,500 bales, up 98 percent from the prior week, according to the USDA data released Friday.

CFTC in its weekly report said that speculators had cut net long position by 14,232 contracts to 21,409 in week to May 26.

On the other hand, cotton planting data released by the USDA on Tuesday suggests that planting in the U.S is well behind last year mainly due to rains in west Texas, which was suffering from drought since the last four years. Cotton planting in the U.S was estimated at 47 percent against 35 percent a week ago, while it was down from 61 percent of five year average.

TOP STORIES THROUGH THE WEEK

USDA Forecasts 2015-16 Global Cotton Crop 7 Percent Down

The USDA has projected 2015-16 global cotton crop at 111.3 million bales, down 7 percent or 8 million bales below 2014-15 estimate. USDA said area reductions in many countries are expected to account for the bulk of the 2015-16 production decrease. World cotton area is estimated to be 6 percent lower at 31.8 million hectares (ha), lowest since 2009-10, while global yield in 2015-16 is forecast below the last several seasons at 763 kg/ha. Two largest producing countries, India and China would account for combined 51 percent of the world crop in 2015-16, slightly higher than in 2014-15. India is forecast to become the world’s leading producer in 2015-16. Indian cotton area has been projected at 12 million ha, down from 2014-15 but near the average of the three previous seasons. China is forecast to produce 27 million bales in 2015-16, 10 percent below a year earlier and the smallest crop since 2003-04. Pakistan and Brazil may produce smaller cotton crop in 2015-16. On the other hand, Brazil’s cotton crop is projected at about 6.8 million bales, 3.5 percent below 2014-15, as area is expected to decline to its lowest since 2012-13.

Cotton Prices In China, World Remain Weak

Cotton prices in china last week (18-22 may, 2015) declined. National cotton harvest and delivery were virtually completed. China’s cotton ginning reached 95.2 percent of procured cotton. New cotton sales reached 66.1 percent. Xinjiang cotton harvest, delivery and ginning are virtually completed. Sales fell 35.4 points to 64.6 percent. World cotton prices also fell as CCI’s export tender and a rumored reserve sale by Chinese govt weakened sentiment. Yarn and fabric sales were also down, with yarn prices moving downward. On May 22, C32s carded yarn was quoted at 20860 yuan per tonne, down 20 yuan or 0.1 percent from the prior week.

Egypt’s Cotton Exports Grow 94.3 Percent On Year

Cotton exports by Egypt rose by around 94.3 percent year on year during the second quarter of 2014-15 to reach 246,000 metric quintals, as per CAPMAS. Same period last year, the country exported around 126,600 metric quintals. CAPMAS attributed increased export to low Egyptian cotton prices due to the increased inventory of cotton since the previous season. Amount of ginned cotton has increased by 26.2 Percent to reach 1.3m metric quintals during the period from December 2014 to February 2015.

Heavy Rains Hamper Cotton Planting, Growth In U.S.

Heavy rains and unfavorable weather pattern in the U.S. over the last four months have kept most of the farmers out of the field. Planting got delayed particularly in the areas where the bulk of the cotton is planted. Cotton farmers in Oklahoma have time to plant anticipated acreage, but the crop will be late. Especially in Texas, cotton plantings are delayed, raising concerns about next season’s crop in the state. The situation has prompted some farmers to swap out acres for other crops like grains, surghum etc, market sources said. However, rainfall may boost yields for 2015-16 crop to be harvested at the end of this year. As of May 24, cotton farmers in Texas had planted just under a third of their intended 2015-16 Crop, USDA data showed, well below 47 percent at the same point last year and the prior five-year average of 50 percent.

Textile Associations Demand Removal Of Law On Cotton Transport

A group of eight textile associations have urged the government to scrap the canotage law to help cut costs in transporting cotton from Gujarat to Tamil Nadu. As per the law, an Indian vessel will be given first preference for the transport of goods from one port to another within the country. Any foreign vessel will be allowed only when an Indian vessel is unavailable. Doing away with the law would help save hundreds of crores of rupees, as per the associations. 50 percent of the cotton used for textile manufacturing in Tamil Nadu is purchased from Gujarat, associations said. They said that if the law is relaxed, the industry would save nearly 250/bale.

CCI Eyes Bangladesh As China Imports Lesser Cotton

The Cotton Corporation of India (CCI) eyes bangladesh to scale up its cotton exports after China lowered imports from India, as reported by media. CCI CMD B.K.Mishra informed that the agency has started issuing ads inviting global parties to directly get registered with the agency for purchase of cotton for the Bangladesh market. CCI chose Bangladesh as the logistics are better and easier to manage either by sea or roads.

Tamil Nadu Textile Units Urge Govt To Solve Issues

Textile units in Tamil Nadu have urged the minister of state, road transport, highways and shipping to solve issues the industry is going through. They demanded the government to provide relaxation of cabotage laws, access to man-made fibres at international prices and also install mega solar power projects at the spinning mills. Regarding Man-Made Fibre, They Demanded The Union government to rationalise the duty structure of polyester and viscose fibre to enable Indian textile industry access man-made fibre at international prices, so that the industry could tap the vast opportunities in the global MMF apparel market.

Govt Targets $47.5 Billion Textile Exports In 2015-16

Government of India has targeted textile exports worth $47.5 billion in 2015-16, eyeing almost 14 percent rise from 2014-15. In the last fiscal, India’s overall textile and garment exports grew roughly 5 percent to $41.4 billion compared to a year ago. But it fell short of the official target of $45 billion. With demand from china remaining tepid and government withdrawing certain export incentives to the sector, shipment target for current fiscal would be hard to achieve. Countries like Vietnam, Bangladesh And Pakistan pose stiff competition for India.

CCI Likely To Incur Record Losses Of Around Rs. 2.5k Cr

CCI is likely to face record loss of nearly Rs. 2,500 crore on its cotton procurement this season, media quoted Textile Minister Santosh Kumar Gangwar. This is because the agency has procured 8.7 million bales of cotton so far in 2014-15, just a tad lower than the record procurement of 8.9 million bales in 2008-09. Cotton prices have been remaining subdued for a long time this year due to poor Chinese demand. But losses would be much lower than those of Rs. 4,000 crore estimated earlier. The minister even said that losses can be even lower than Rs. 2,500 crore if market prices of cotton improve.

Central India Unlikely To Receive Monsoon Before 20th June

The Indian Institute of Tropical Meteorology said that central india will not receive monsoon before 20th June. Although rainfall is expected to increase around 6 june over the southern peninsula, it is expected to remain confined to north east and southern peninsula for next 10 to 15 days. The weather forecaster also said that the onset of monsoon will be on time, though it will be weaker than normal.

OUTLOOK FOR NEXT WEEK

Movement in cotton prices may most likely be steady to firm in the next week at the back of rising demand. Market sentiment will primarily be dependent on CCI cotton sale. After CCI’s statement that it will not lower its prices even if it fails to record good sale at its E-auctions will force mills to buy stay firm in the commodity.

(By Commoditiescontrol Bureau; +91-22-40015522)