Mumbai, May 17 (Commoditiescontrol): Malaysian palm oil futures experienced a significant upswing on Friday, closing the week with substantial gains. This upward trajectory was primarily driven by bullish trends in competing oils within the Dalian and Chicago markets.

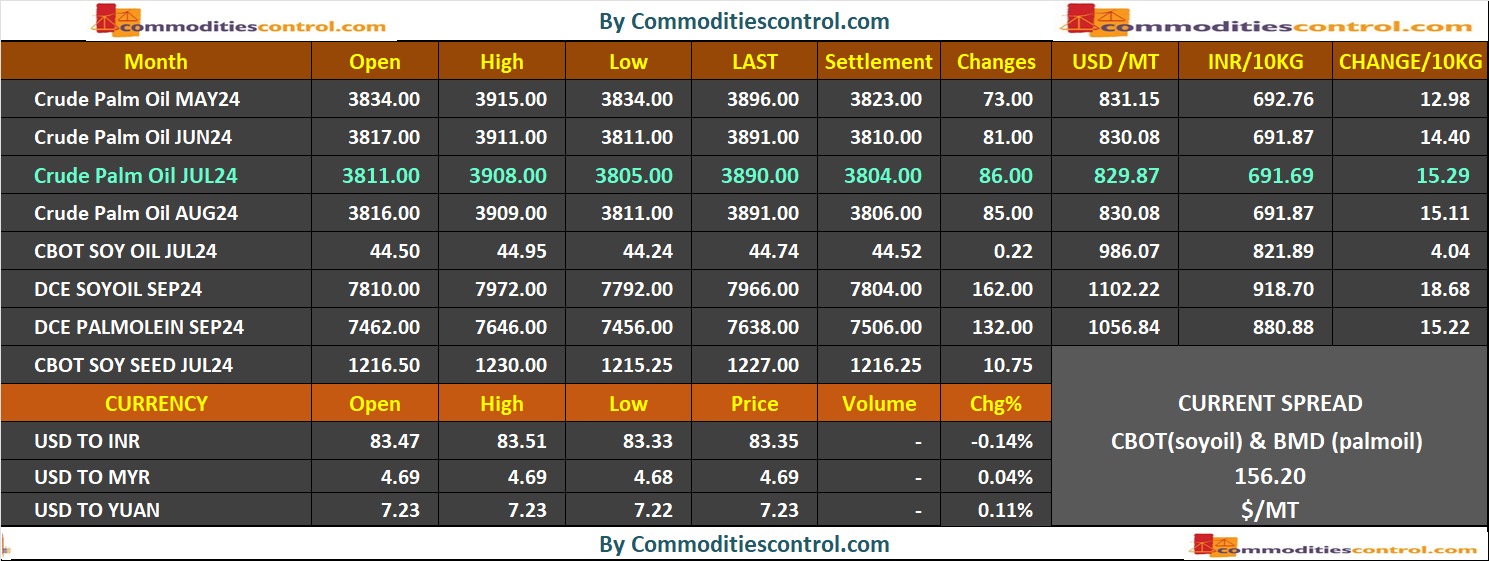

The benchmark palm oil contract for August delivery on the Bursa Malaysia Derivatives Exchange concluded at 3,890 ringgit ($830.31) per metric ton, reflecting a notable 2.26% increase or 86 ringgit. This surge contributed to a weekly gain of 2.13%.

Market analysts attribute this positive momentum to the overnight surge in Chicago soyoil futures and robust prices in South American markets. Notably, Dalian's most-active soy oil contract experienced a 2.08% rise, while its palm oil contract also gained 1.76%. Soyoil prices on the Chicago Board of Trade witnessed a 0.47% uptick.

Adding to the bullish sentiment, Malaysia announced a reduction in the reference price for crude palm oil to 3,956.06 ringgit ($845.13) per metric ton for June. This adjustment, coupled with a maintained 8% export tax, further fueled investor optimism.

However, data from cargo surveyors Intertek Testing Services and Societe Generale de Surveillance (SGS) revealed a decline in Malaysian palm oil product exports for the first half of May, potentially tempering the overall market enthusiasm.

Additional factors influencing the palm oil market include the soybean harvesting progress in Brazil's flood-affected Rio Grande do Sul state and the stabilizing oil prices, which render palm oil a more appealing option for biodiesel production.

Traders who are long may hold till prices reach its target of 3925 with stop loss placed at 3825, The Malaysian palm oil on daily timeframe seems to be in a consolidation phase

Global Futures Palm oil and Soy Oil

(By Commoditiescontrol Bureau; +91-9820130172)