Mumbai, June 18 (Commoditiescontrol): During the week ending June 17, 2023, Burma Tur prices experienced an upward trend, rising by Rs 50-200 per quintal. This increase was driven by strong Myanmar CNF rates and moderate gains in the prices of tur dal produced from imported Tur, which was being offered at a significant discount compared to desi Tur dal. As a result of the sharp rise in desi Turdal prices, cost-sensitive customers switched to imported Tur dal instead of desi Tur dal. Consequently, this shift led to a slight decrease in desi Tur and Tur dal prices.

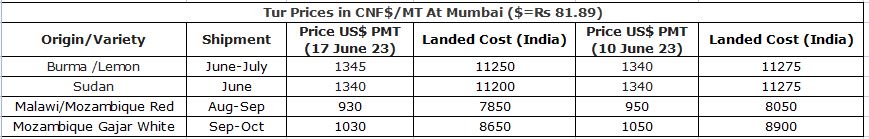

Regarding forward deals, the price of Lemon Tur ready for delivery in Chennai stood at Rs 10,150. However, prices for July-August delivery were higher, ranging between Rs 10,350 and 10,800. Consequently, the CNF Chennai price for Burma Lemon Tur increased by $5, reaching $1,345.

On the other hand, the domestic variety of Tur in the bilty trade at Akola faced weakness, declining by Rs 100-175 to Rs 10,400-10,425 per 100kg. This was primarily due to limited buying activity from local and outstation millers and traders, as the demand for desi Tur dal remained relatively sluggish. However, resellers actively participated in Tur dal trading, capitalizing on the prevailing rates to secure profits. In Gulbarga's mandi, Tur prices traded higher by Rs 100, ranging from Rs 10,200 to 10,400 per 100 kg, depending on the quality. This rise was due to millers' immediate requirement for crushing.

Tur dal prices in the Akola markets witnessed a decline of Rs 200, as buyers from wholesalers and retailers showed less interest at higher rates. Conversely, Katni experienced a gain of Rs 250 as it was trading at a discount to domestic origin tur dal at other centres. Meanwhile, Gulbarga observed a steady trend.

The surge in demand for Tur dal processed from Tur sourced from Mozambique, Burma, and Sudan led to a Rs 100 price increase per 100 kg, driven by the need-based off-take. Additionally, Tur dal processed from imported Tur remained significantly more cost-effective than its domestically processed counterpart.

On other hand, The prices for Tur from Mozambique both white and gajri variety remained weak by Rs 50-100/100Kg on thin mills demand. While, Malawi and Sudan origin Tur stay unchanged on limited mills trade activity.

According to trade sources in Burma, there is a considerable amount of Tur stock held by traders and stockists who are hesitant to sell at the current price. They anticipate further price escalations due to a deficit in Indian production. However, the elevated CNF prices for Chennai have resulted in a significant import disparity, which acts as a deterrent for further imports. Meanwhile, the Burmese kyat has remained stable against the US dollar, trading at 2,850 Kyat per dollar.

Trend:While the Tur market fundamentals remain strong, there are indications of an impending price correction as traders seek to capitalize on the current high prices. Tur dal demand is currently facing significant market resistance due to its premium pricing compared to other pulses. This situation is further exacerbated by strict government price monitoring measures, resulting in stockists offloading their holdings. The upcoming influx of African supply, anticipated to arrive in early August, will likely exert additional downward pressure on prices. The recent price increase has been driven primarily by traders and stockists holding back their stocks in anticipation of further price rises. However, with mounting resistance to these high prices and the imminent arrival of African-origin Tur, a substantial wave of selling is expected from both domestic and Burmese stockists, which may result in price correction.

(By Commoditiescontrol Bureau: 09820130172)