Mumbai, 8 Jul (Commoditiescontrol): For the week ending 08th July Tur market continued to show resilience as market participants keenly monitored weather patterns and assessed potential impacts on the Kharif sowing season. The week saw significant price hikes for African and Myanmar-origin Tur due to concerns about delayed Karif sowing and low domestic stocks supported by speculative activity in Burma Lemon Tur. Similarly, domestic-origin Tur prices followed suit, reflecting the upward trend seen in international-origin varieties.

African-origin Tur emerged as the star performer in the Raw Tur category, its price increase primarily attributed to dwindling stocks in the Indian market. This left millers who depend on African Tur for processing with no option but to purchase it at elevated prices to keep their operations running. Meanwhile, the price of Lemon Tur also escalated due to a dip in domestic availability and reduced imports, a direct consequence of a substantial import disparity.

.jpeg)

In the Yangoon market, Burma Tur saw a gain of $15/mt, closing at $1290/mt in CNF India Terms, following increased buying activities from India. This equates to an approximate landed cost of Rs 10900/quintal at Chennai port compared to the spot price of Rs 9975/quintal, resulting in an import disparity of Rs 925/Quintal.

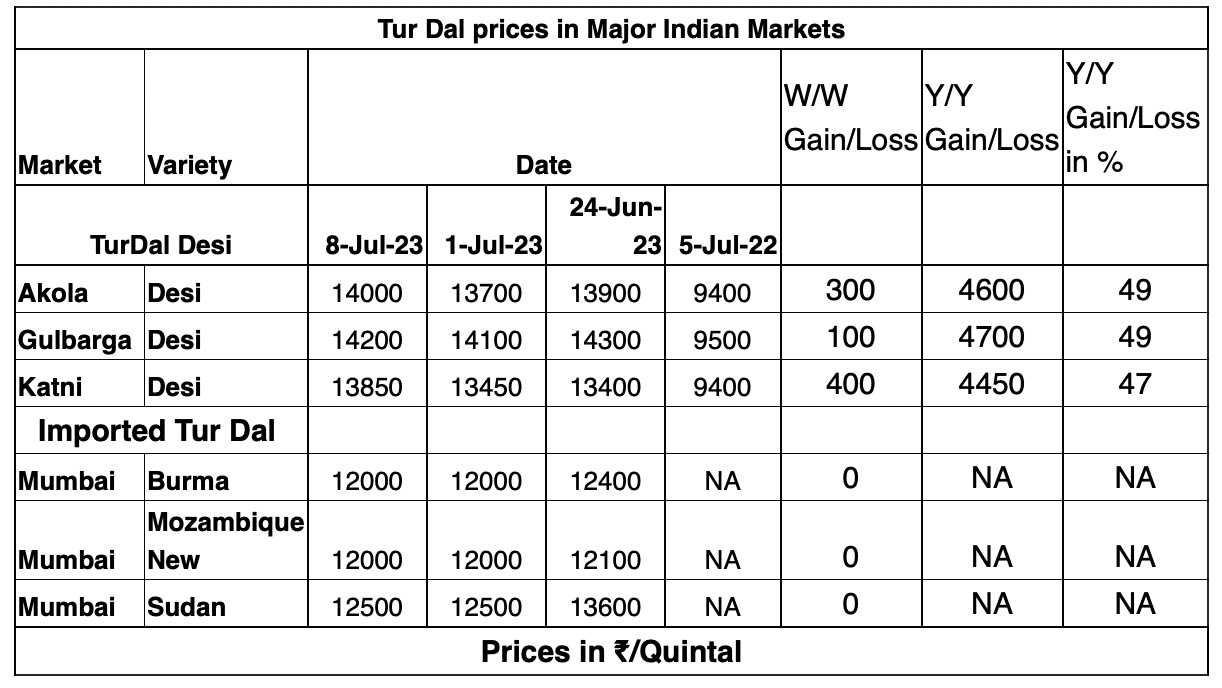

In terms of processed products, Tur dal made from desi Tur saw weekly gains of Rs 100-400 per quintal, but African-origin Tur dal prices remained stagnant despite the significant jump in raw Tur prices. This resistance in demand at higher prices underscores a limitation for processors and dal millers who struggle to pass on the escalated raw Tur costs to the buyers.

The raw Tur prices of Indian and Burma lemon have surged by approximately 54% year-on-year, with African Tur prices leaping by 60% within the same period. Meanwhile, processed Tur or Turdal prices from India have registered a gain of around 49%, resulting in a 5% shrinkage in profit margins for millers. This significant disparity, combined with reduced Tur availability due to lower crop yields, has forced the closure of almost 70% of mills. Despite the low level of Tur dal being crushed, resulting in a reduced supply, the anticipated effect on Tur dal prices, which would typically be a rise, has not been observed. This suggests a resistance to higher prices from the demand side. Conversely, Tur prices continue to increase, indicating a potential trend of stockpiling rather than utilizing it for making Tur dal.

Despite these challenges, purchases continue at higher rates, likely driven by speculative buying rather than crushing needs. A significant number of the mills still operating are likely to be financially well-managed, and may have already covered their requirements at earlier, lower prices. Some millers who are buying for crushing purposes are likely banking on an anticipated price surge to recoup their losses.

The latest Kharif sowing data shows a considerable reduction in the sown area of Kharif Tur compared to the previous year. However, recent significant rainfall in major Tur belts such as Maharashtra and Karnataka offers hope for a rebound in sowing in the coming weeks.

If this sowing turnaround occurs, we could anticipate an upsurge in selling activity from domestic stockists, traders, and Burmese stockists. They would likely aim to capitalize on their profits ahead of the new crop of African Tur entering the Indian market. Given the current price levels — a significant 60% higher than this time last year. African farmers and exporters might adopt aggressive selling strategies. As they know, the current price premium may not sustain if sowing significantly recovers.

In summary, the prices of Tur could experience a significant decline if India's Kharif sowing continues to recover in the upcoming days, which is contingent upon the progress of the Monsoon. If the weather remains favourable, as it has been in the last few days, we can anticipate substantial selling pressure in Tur, resulting in a price correction in the coming days.

(By Commoditiescontrol Bureau: 09820130172)